Newsletter

M&A Comes to Private Equity

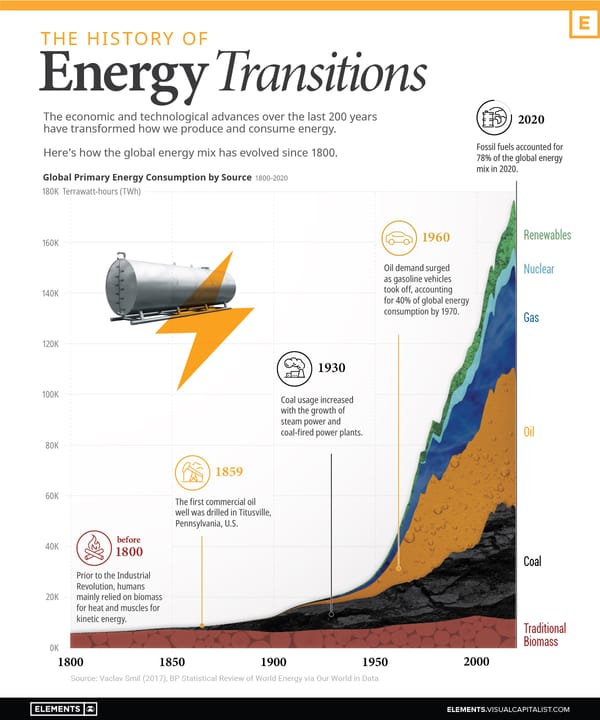

Energy transition and AI growth power renewed interest in infrastructure

Newsletter

Energy transition and AI growth power renewed interest in infrastructure

climate

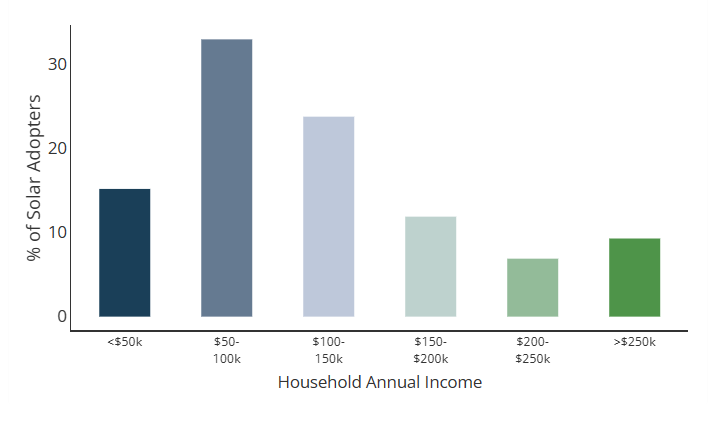

It's easy to villainize people who make different choices than we do. But does that mean they are anti-sustainability, or do they just have different priorities that we do?

Newsletter

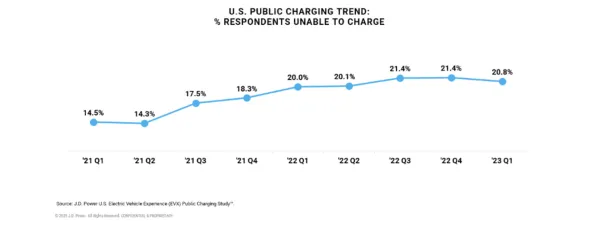

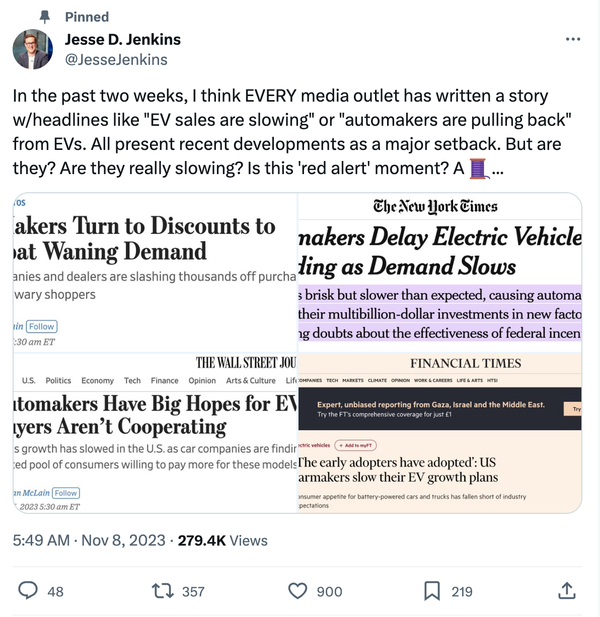

What happens when perceptions don't reflect reality?

climate tech

The news covering solar, wind, and electric vehicles has been negative lately. Are things as bad as they seem?

climate

We can't predict the future, but what can we count on to remain the same?

climate

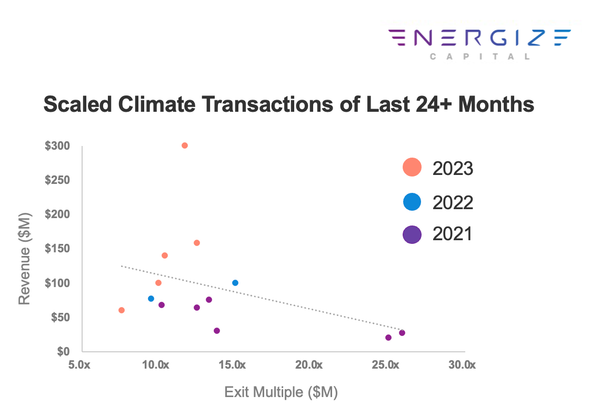

5 reasons why climate M&A is primed for an active 2024

investing

Recently, someone asked me, "How would you identify yourself as an investor?" "I try hard not to." My answer surprised the recipient. I have thought a lot about this over the last 5+ years. Since reading Poor Charlie's Almanack, The Most Important Thing, and

investing

If you asked 100 people their definition of investing, you would likely get at least 90 different answers. The explanation that’s always stuck with me is: The art and science of allocating finite resources for optimal outcomes. The line is captivating because it applies to almost everyone and everything.

Newsletter

And why surviving them matters

climate

Why now is the time to be a Growth investor in climate.

climate

Adoption gives way to a new type of risk

Newsletter

On a recent flight to Mexico City for vacation, Anita noticed a price tag on the back of a recent book I purchased. Anita:" Where did you get that? " Me: "On Amazon a few days ago." Anita: "I hope you didn't pay more