Edge

edge (n): a quality or factor that gives superiority over close rivals or competitors.

Value matters more than price.

That statement in a market where software revenue multiples have gone from 47x NTM to 5x NTM in 15 months might seem controversial.

I’m not implying price doesn’t matter, far from it, it matters a lot and it creates the returns hurdle for which you must clear. But, value is the most under-discussed and under-analyzed term of this cycle and not for the reason you might think.

At a conference this weekend I heard a Blackstone board member frame value around the firm’s “edge” in the most succinct and impactful way.

“In our best deals, every entry price we’ve ever paid looked overvalued. By the time we were done operating the asset and sold it, the entry price looked extremely undervalued. That’s how you quantify edge.”

Three days later, I was struck by a similar point framed in a different way.

On the latest episode of 20VC, Orlando Bravo was asked the question “how do you defend the prices Thoma paid for Coupa and Anaplan and what do you say to those who say you overpaid?”

Bravo’s response:

“First, people don’t know what our plan is with the assets. We have an operational playbook that we know we can execute to create value for our investors. Second, we love inefficient businesses that we understand well because if they were perfectly efficient we’d have to pay retail.”

Price creates the hurdle and Thoma believes their operating edge is so large that even a higher price than the market is willing to pay now will look cheap later, the value.

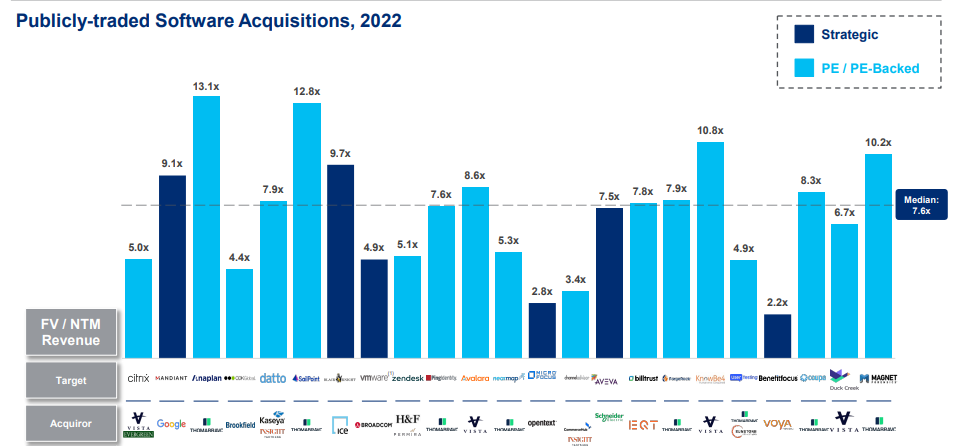

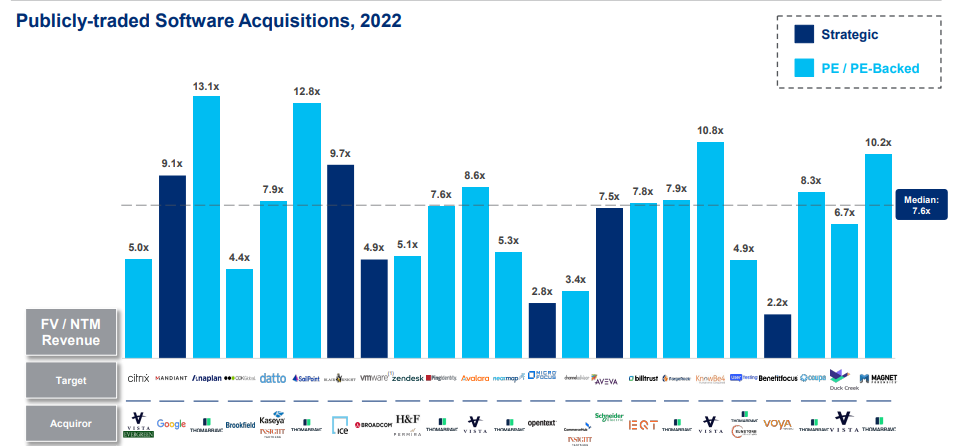

In the chart below, Thoma paid 13.1x and 12.8x for assets in a market where 5x was the norm.

Crucially, Thoma didn’t pay more for the sake of paying more. Instead, they have decades of data that form operating playbooks which are then leveraged to help them create shareholder value others can’t see or underwrite. That’s edge.

Thoma doesn’t take big risks in their investments given their strategy, and you don’t get to keep buying assets at those prices without a lot of trust from your investors and a track record to match.

I’ve said many times that I believe Thoma’s 2022 fund will be the best-returning fund of all time. While everyone else worries about price, Thoma thinks about value and where multiples will be in 4-5 years when they are ready to sell their assets.

If this strategy pays off, it will be the greatest example of edge defining value we’ve ever seen.

Thanks for reading Sustainable Returns! Subscribe for free to receive new posts.