Electrified - Issue 32

The Artist Formerly Known as The Charging Station

Hi friends,

Welcome to the long weekend. This week, you’ll notice I’ve changed the name of the newsletter to Electrified.

Why? I wanted a simple name that better captures what our newsletter is about: the electrification of everything and the consequences that come along with it.

Let’s jump in.

This week, the Trump Administration proposed a new rule from the Labor Department that would effectively ban pension-plan administrators from making any kind of ESG offering part of the default option in a 401(k) plan, and discourage them from having any ESG options at all.

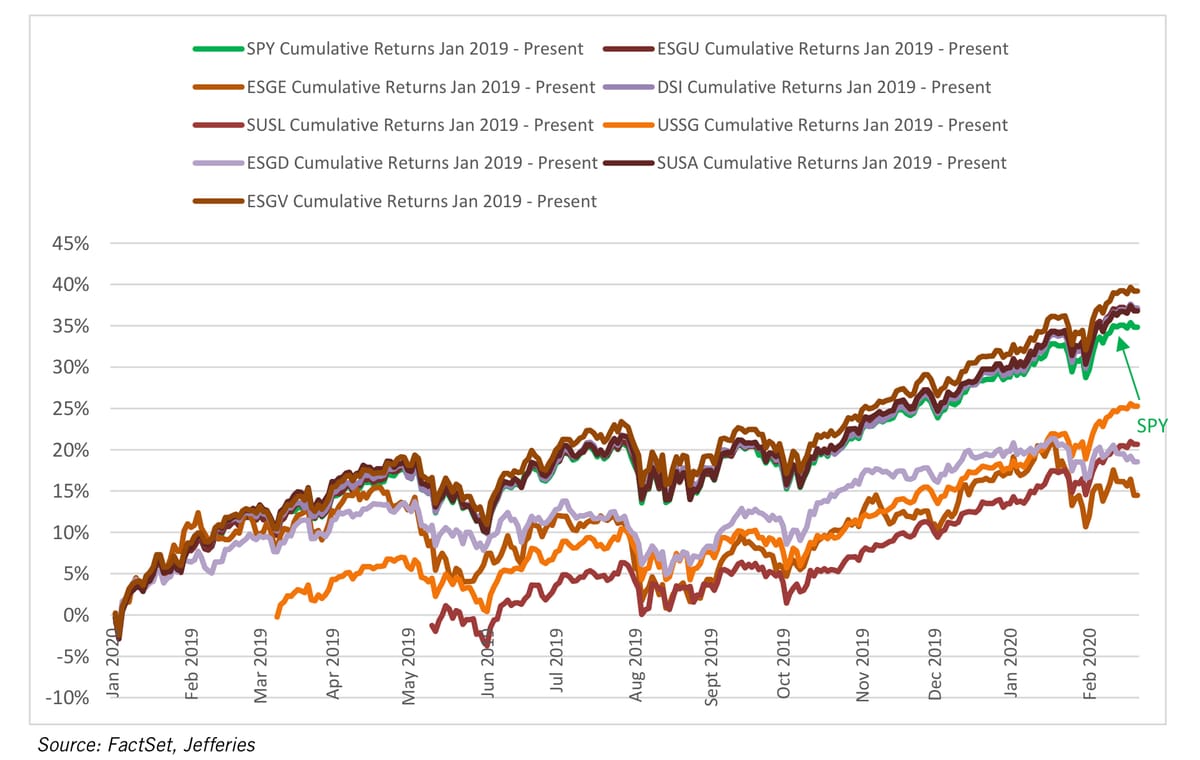

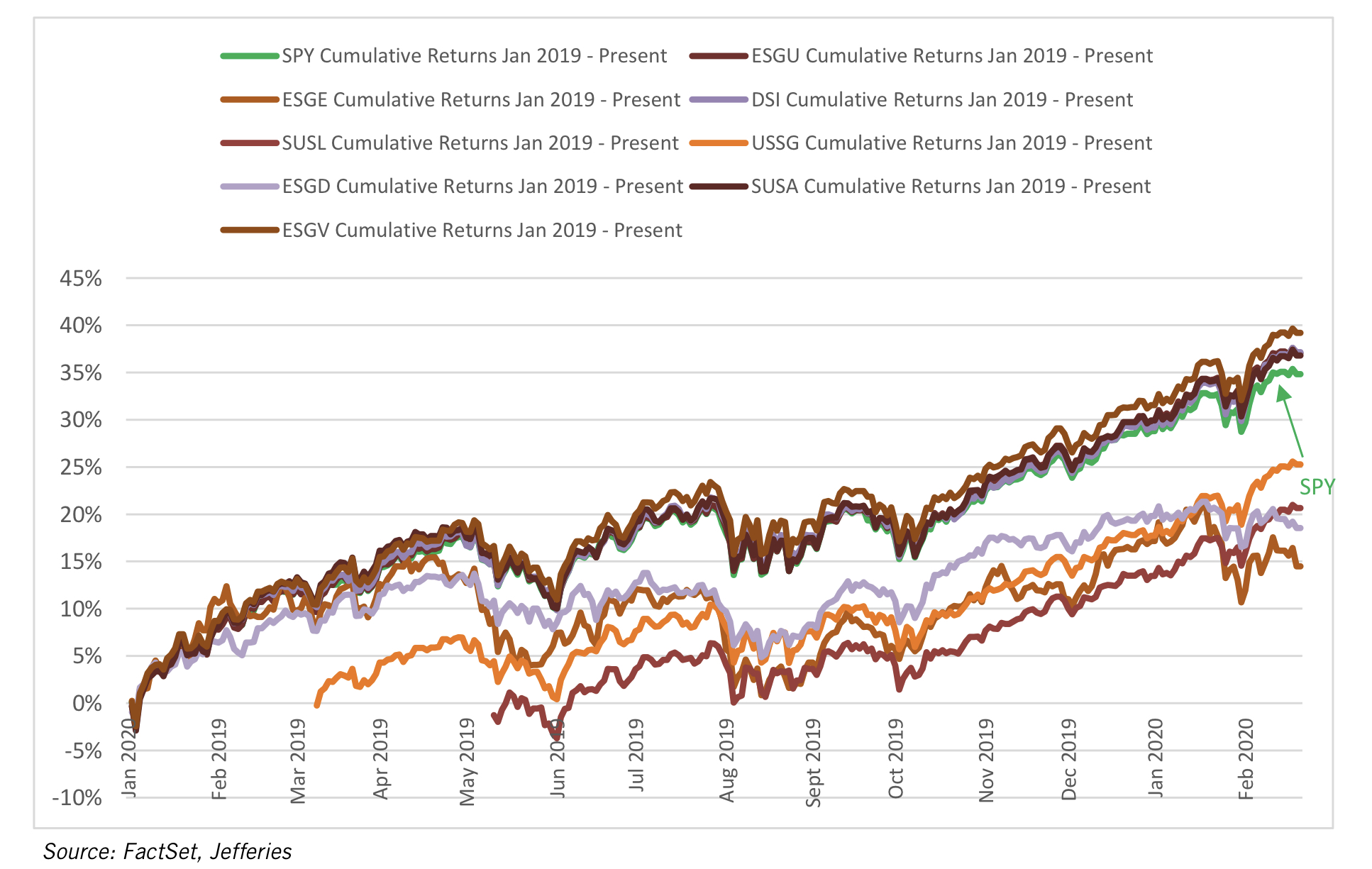

Labor Secretary Scalia wrote in his recent Wall Street Journal op-ed that a focus on ESG causes returns to suffer which is not true. At best, the jury is still out.

ESG funds — especially the top performing ones — beat the market. In 2019, a year when the S&P returned 30% and hedge funds had their best year in a decade, the four largest US ESG ETF’s outperformed both. If you want to make the argument that causation is not correlation, I’m all ears.

It’s likely this is all a moot point, a growing number of financial institutions — including Blackstone and Goldmans Sachs — are now requiring that sustainability be considered as a factor in capital allocation decisions.

As I’ve written previously, carbon footprints will eventually be a determining factor in a firm’s cost-of-capital which leads to market-driven sustainable companies. Much like every company is now a technology company, soon every company will be a sustainable one too.

👉 If you enjoy reading Electrified, please share it with friends!

Links:

— The World Isn’t Ready for Peak Oil

— Nuclear Energy is Climate Justice

— Want jobs and clean energy? This overlooked technology could deliver both

Go deeper:

1.

The world is, after all, in the midst of an inevitable transition away from fossil fuels, and there can be little doubt that an effective climate-change strategy will reduce substantially the demand for oil. The details of the efforts to combat climate-change will determine how—and how soon—the world reaches peak oil. But reach it, it will, or perhaps it already has. And as it does, the international community must be prepared to manage the fallout in countries that depend on oil for their revenue.

“The coronavirus oil shock is not a one-off crisis; it is a dress rehearsal for a future fast unfolding.”

— The World Isn’t Ready for Peak Oil

2.

The availability of cheap, reliable energy is a necessary component to improving quality of life, job creation, and increasing productivity in Africa. It is unrealistic to expect economic growth or rising incomes without adequately addressing energy poverty. Africa has a total installed electric capacity of around 150 gigawatts, “a level comparable to the capacity China installs in one or two years.” By 2040, the continent’s electricity demand could more than triple.

“The global campaign against climate change is being waged at the expense of those least responsible for it and worst affected by it.”

— Nuclear Energy is Climate Justice

3.

America’s power grid is aging and fragmented. Much of it was built a half-century ago or more, with many lines designed to carry electrons from coal-fired power plants or hydroelectric dams. The western and eastern parts of the country operate on largely separate networks, each of them divided into dozens of smaller jurisdictions. Texas has its own, largely disconnected grid.

“It’s increasingly embarrassing to see how we’ve dealt with infrastructure investments in the United States, all we can seem to figure out how to do is build more highways.”

— Want jobs and clean energy? This overlooked technology could deliver both

What I’m thinking about

The best businesses are able to simplify to achieve their mission, how can we apply that to our own goals?

See you next weekend,

Kevin

Did your brilliant friend forward this to you? Join our community by signing up below: