Electrified - Issue 40

Attack of the SPAC

Hi friends,

Hello from Texas where it’s 105F in the shade and feels like 114F. Apparently, the only thing hotter than our summer is the SPAC market. Let’s dive in.

Trivia question: Which company trades at ~15,260x EV/LTM (last twelve months revenue) as of Friday afternoon?

Special-purpose acquisition companies, or SPACs, have made a splash in 2020, especially in the tech world.

I don’t pretend to know all of the details on SPACs, but I figure like me, some of you may want to understand them better. Here are the basics:

- SPACs raise money from IPO investors and place it in a trust until the sponsor identifies and negotiates a merger with an operating company. The target becomes a publicly-traded stock.

- Each SPAC comes with a share and warrant IPO. Most price the stock at $10 per share and the warrants at $11.50. The variable is the warrant fraction which is based on the demand for the SPAC.

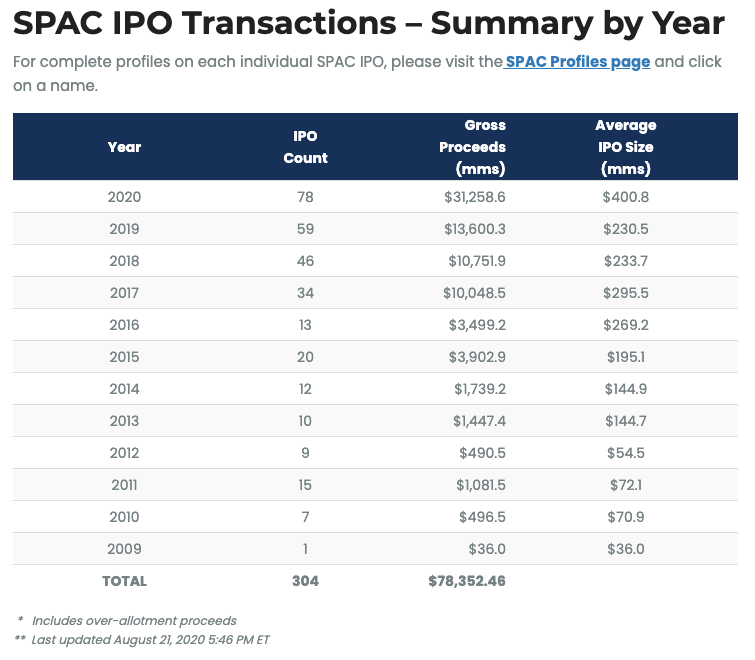

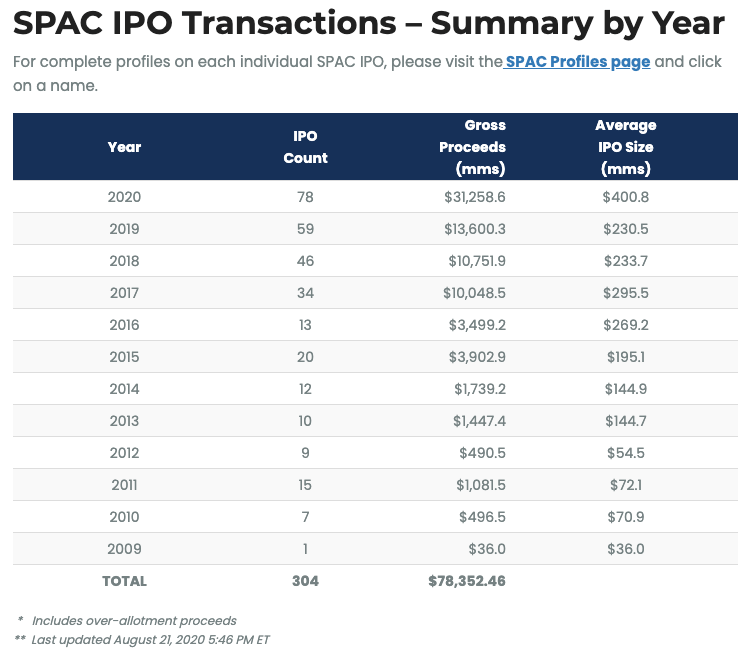

A record number of SPACs have been raised in 2020, and at a much higher capital raise per deal. Currently, over $30B is held in SPACs, and at the current pace, 2020 will finish 3-4x higher than any other year.

Traditionally, SPAC terms tended to be more onerous than that of traditional IPO filings. The numbers above highlight a new level of competition entering the market which has led to better terms, and a lower cost-of-capital for the company being acquired.

The valuations of recent SPACs like Luminar and Desktop Metal have come under intense criticism and scrutiny. But, they solve an important piece of the puzzle for investors and founders in hard tech, which will play a role in the energy transition.

SPACs create a new avenue for liquidity, particularly for early-stage investors and entrepreneurs who want to capture some of the wealth they've created, and unlock a new way to access long-term capital for companies that have 20+ year goals.

As a result, we have increased the incentives for founders to tackle hard problems and for investors to back them at the earliest stages - something we desperately need to solve the technological challenges of the energy transition.

Who are the most obvious candidates for SPACs in the energy tech world? Let's start with a set of criteria.

- Proprietary, hard-tech

- Founded 7-10 years ago

- A large market with room for growth

- Current investors might need liquidity

Using these qualifiers, we can select companies where an influx of capital will scale a costly, but defensible technology. We also need a growing market where winners will have a long-term advantage.

Here are my top 5 candidates:

1. ChargePoint

Description: ChargePoint develops and manufactures technology for its network of electric vehicle charging stations.

First Raised: 2009

Last Raised: 2020

Total Funding: $660M

2. Skydio

Description: Skydio uses artificial intelligence to create flying drones that are used by consumer, enterprise, and government customers.

First Raised: 2015

Last Raised: 2020

Total Funding: $170M

3.Carbon

Description: Carbon is reinventing how polymer products are designed, engineered, manufactured, and delivered, towards a digital and sustainable future

First Raised: 2013

Last Raised: 2019

Total Funding: $583M

4. General Fusion

Description: General Fusion develops utility-scale fusion power using magnetized target fusion.

First Raised: 2009

Last Raised: 2019

Total Funding: $192M

5. Smart Wires

Description: Smart Wires specializes in grid optimization solutions that leverage its patented modular power flow control technology.

First Raised: 2011

Last Raised: 2019

Total Funding: $179M

Trivia answer: Nikola

👉 If you enjoy reading Electrified, please share it with friends!

Links:

— Digitization bolsters utility rate cases, boosts drive to future-proof

— How weaponizing disinformation can bring down a city’s power grid

Go deeper:

1.

"We think we're going to see a new category of companies called wind and solar majors," said Sam Arie, a research analyst at UBS, the Swiss investment bank. "They're on the way to being the size of the oil majors."

2.

“Instead of "being on the defensive, saying, ‘We’ve done a good job with stewardship requirements with the investments we’ve made,’ which is a hard argument to make and usually is met with criticism," utilities now can present data simulations portraying the scenarios they expect during the next rate period, he said. They can offer commissioners fact-based assumptions.”

— Digitization bolsters utility rate cases, boosts drive to future-proof

3.

“We demonstrated that an adversary can cause blackouts on a city scale, not by tampering with the hardware or hacking into the control systems of the power grid, but rather by focusing entirely on behavior manipulation.

For instance, despite high levels of security, human operators proved to be the weakest link during the Stuxnet attack on the Iranian nuclear program, unwittingly introducing malware into the facilities.”

— How weaponizing disinformation can bring down a city’s power grid

Recent Investment Activity

Raptor Maps, a system-of-record software for Solar, raised its Series A from Powerhouse Fund, Blue Bear Capital, Buoyant Capital, and return investors Y-Combinator.

EnergyX Solutions, an emissions reduction software for utilities, raised $1M in funding led by BDC Capital.

The Demex Group, a Washington DC-based climate financial risk solution, raised $4.2M in seed funding. Anthemis and IA Capital Group were the investors.

Xos Trucks, a Los Angeles, CA-based manufacturer of fully electric commercial vehicles, raised $20M in funding. Backers included Proeza Ventures, a mobility-focused VC firm backed by Metalsa’s holding company, and Build Capital Group.

Parsable, a San Francisco-based platform for industrial companies, raised $60M in a Series D funding. Activate Capital and Glade Brook Capital Partners co-led the round, and were joined by investors including Lightspeed Venture Partners.

💰Any deals we missed or you would like us to share? Submit them here.

Exits

OSIsoft, a real-time data management software, was acquired by British IT company AVEVA for $5 billion.

Luminar, a LIDAR startup for autonomous vehicles is merging with special purpose acquisition company Gores Metropoulos Inc., with a post-deal market valuation of $3.4 billion.

What I’m thinking about

It’s not about being right, it’s about getting to right.

See you next weekend,

Kevin