Electrified - Issue No. 41

How low can we go?

Hi friends,

Happy Labor Day weekend. I hope you are all enjoying extended time with your family and friends. Let’s get to it.

A recent Electrified podcast (coming soon) guest said his theme for 2020 was "COVID accelerates X" and promptly told us never to use that phrase. Sorry, Ryan.

COVID accelerates the trend of negative energy prices

The COVID pandemic has drastically decreased commercial and industrial power demand across the globe. As a result, some countries like the UK and Germany are seeing an acceleration in the occurrence of negative wholesale energy rates.

Germany has seen the most instances of negative prices. In the 15-minute intraday auctions of power for on the Epex Spot SE exchange, rates fell below zero 773 times in the first quarter, a 78% jump from the same period a year earlier. Those rates were also 23% lower overall.

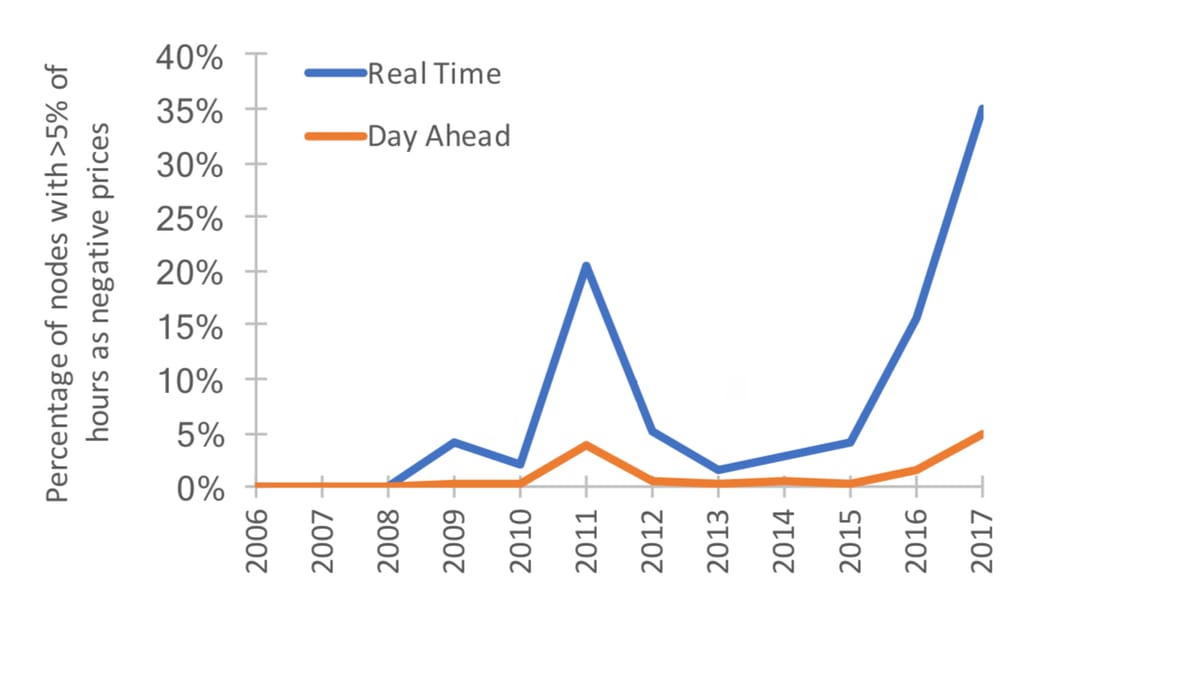

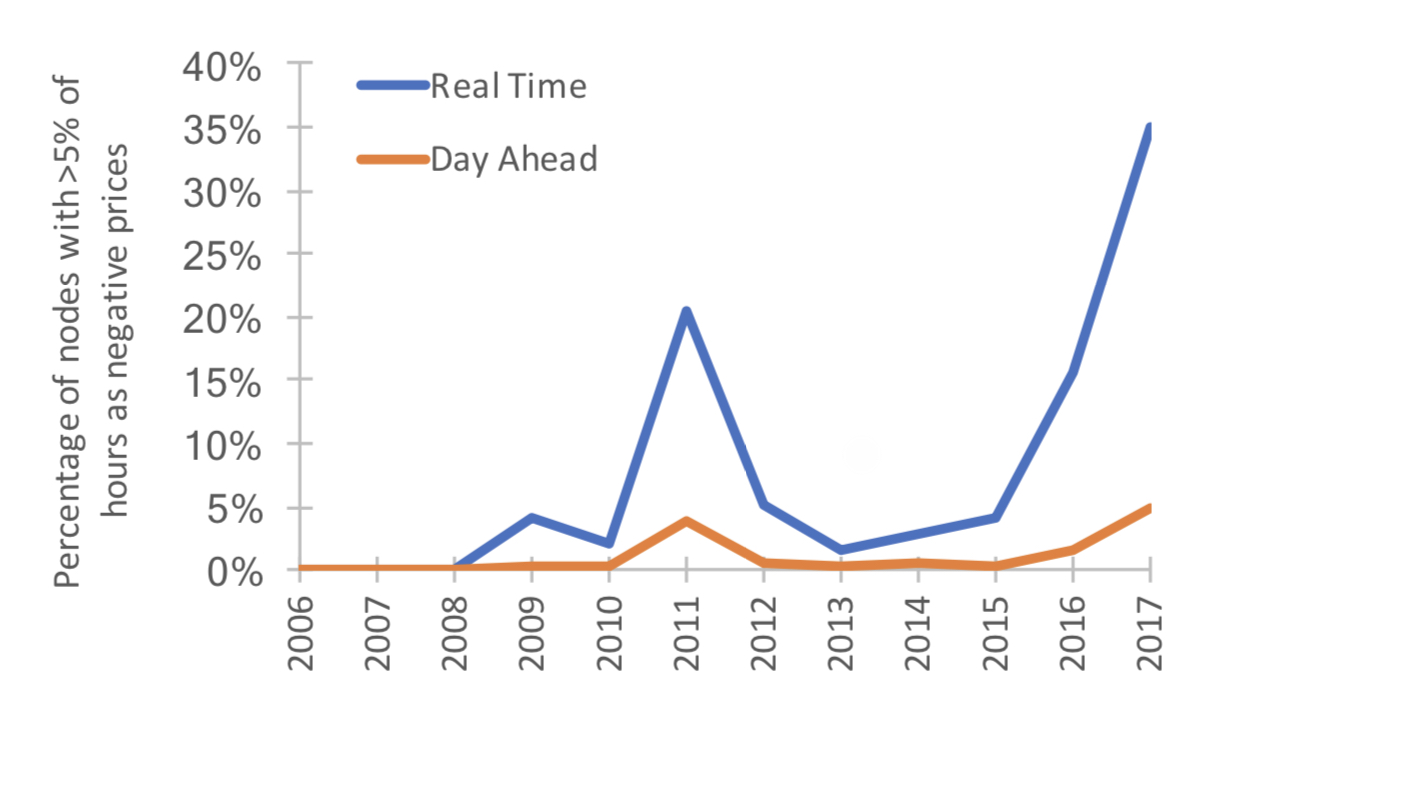

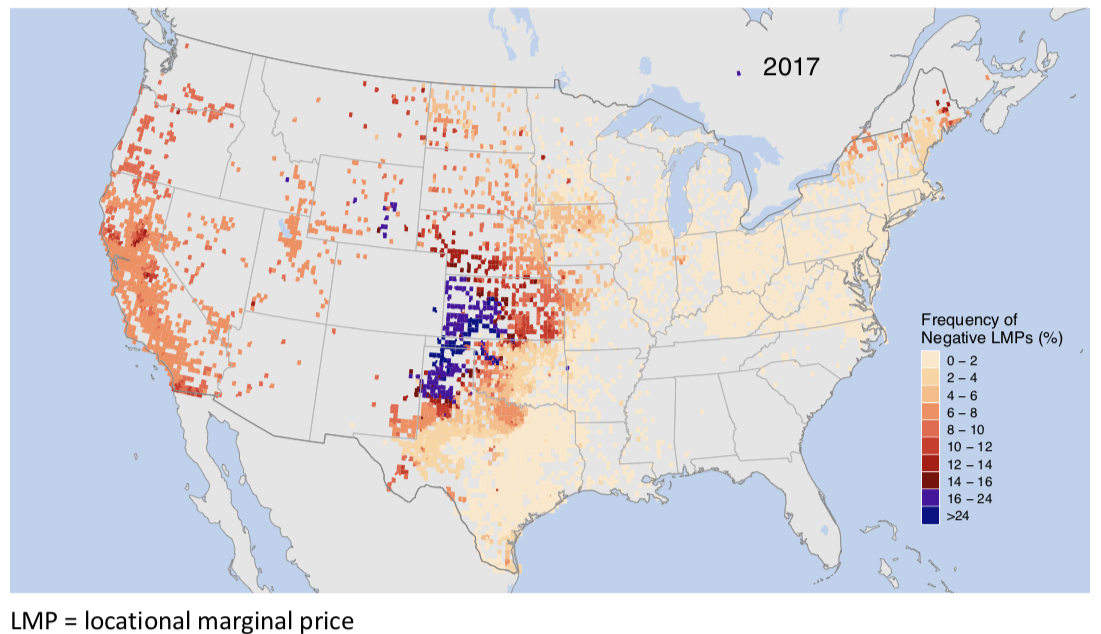

However, negative wholesale rates aren't just a COVID or EU phenomenon. They are increasing in the US too - a trend that started in 2015.

Image source: Lawrence Berkeley National Lab

Why do energy prices go negative?

The reason wholesale energy prices go negative is obvious: supply drastically outpaces demand. Currently, electricity grids in the US and Europe are not flexible enough to dynamically match these two economic forces.

Electricity is a rare commodity in two respects. First, it has zero shelf life, meaning use (or store) it or lose it. Second, power plants cannot start and stop on demand.

This means it is often cheaper for a power plant to remain running during times of negative prices. That’s true for both the immediate term and long-term with maintenance costs are factored in.

Are negative rates good for the customer?

Not yet, and there is a potential downside looming. The majority of residential customers do not participate in the wholesale energy market, and cannot take advantage of lower prices.

Additionally, negative prices mean power generators sell their product at a loss, or when grid operators order wind farms to stop electricity generation, affected generators receive compensation payments.

This has two potentially negative consequences.

First, these costs eventually find their way to the consumer. They may be passed on to the utility which then passes it on to the customer, or if the utility is the generator, passed on to the customer in a rate case.

Second, without long-term PPA's new investment in clean energy generation declines. Less investment in clean energy hampers our ability to reduce emissions in the power sector.

It should be noted that incidences of negative prices do not always directly impact the revenues earned by generators.

Some generators are hedged from market prices through long-term bilateral contracts (e.g., power-purchase agreements commonly used by wind and solar plants), and some do not participate in real-time market balancing.

A Note on Market Structures

One important caveat to today's newsletter: electricity markets are complex and vary across markets. ERCOT (TX), CAISO (CA), PJM (mid-Atlantic + Chicago), MISO (Midwest US), and Europe all have slightly different structures.

The result is a generalization of negative prices, but a broader discussion about which market structures optimize supply and demand is worth consideration.

Markets with higher penetration of wind and solar are more likely to see time segments with negative rates. In the US, ERCOT, CAISO, and MISO are the most susceptible to negative rates. In the EU, it's Germany and the UK.

Negative Rates = New Opportunities

Wind and solar have basically zero marginal cost (remember that once the plants are built, fuel from the wind and sun are free at the margin), and their share of generation will only continue to increase.

Markets grow when consumption is encouraged. This creates more revenue, more investment, and more value for all participants in a system.

If we can connect the consumer to the wholesale markets to access power sources dominated by fixed costs and place a price on the benefits of grid flexibility, new business models will emerge.

For the first time in energy, we’re on a potential path to a market structure that empowers people to consume an unlimited amount of multi-trillion dollar commodity.

Which other modern industry spent decades on fixed costs to ultimately unlock unlimited consumption of a commodity?

Cable, which led to the consumption of data with almost zero marginal cost to the provider.

Otherwise known as, high-speed internet. Is energy next?

👉 If you enjoy reading Electrified, please share it with friends!

Power Down

Energize Ventures’ John Tough and I have started a weekly video series called Power Down. At its core, Power Down is just two friends talking about two of our passions: technology and energy.

We’re still figuring out the content game and will have guests soon. In the meantime, if you want to see what we’re building here’s a clip from the first episode.

Links:

World Added More Solar, Wind Than Anything Else Last Year

The US and climate: New York’s bold green plans hit opposition

Big Oil's patchy deals record casts a shadow over green makeover

Go deeper:

1.

For the first time ever, solar and wind made up the majority of the world’s new power generation -- marking a seismic shift in how nations get their electricity.

— World Added More Solar, Wind Than Anything Else Last Year

2.

“The climate crisis, I have no doubt that it’s coming,” he says. Yet the couple has also placed scarlet signs reading “No massive solar power plant” at the edge of their property. They are protesting against Horseshoe Solar, a photovoltaic project whose 600,000 panels would cover fields usually lush with corn and soybeans.

— The US and climate: New York’s bold green plans hit opposition

3.

The collapse in oil prices since COVID-19 struck has also forced the big companies to wipe billions of dollars off the value of their assets and it has also hit revenue to the point they’ve taken on more debt to keep up payments to shareholders.

All told, the world’s top energy companies have booked asset writedowns totaling $60 billion this year following the slide in oil prices and demand during the coronavirus pandemic.

— Big Oil's patchy deals record casts a shadow over green makeover

Recent Investment Activity

One Concern, a Menlo Park, Calif.-based maker of A.I.-based tech for disaster risk reduction, raised $15 million from SOMPO.

Klima, a Berlin-based startup with an app that calculates carbon footprints, raised $5.8M in seed funding. Backers include Christian Reber (Founder of Pitch), Jens Begemenn (Founder of Wooga), Niklas Jansen (Co-Founder of Blinkist) e.ventures, HV Holtzbrinck Ventures, and 468 Capital.

Myst AI, a startup developing a predictive energy usage platform, closed a $6 million funding round led by Valo Ventures.

💰Any deals we missed or you would like us to share? Submit them here.

Exits

QuantumScape, the 10-year-old Silicon Valley battery startup backed by Volkswagen AG and Breakthrough Energy Ventures plans to go public via a SPAC with Kensington Capital Acquisition Corp at an enterprise value of $3.3 billion.

RealPage (Nasdaq: RP) acquired Stratis IoT, a Philadelphia-based provider of real estate IoT solutions like energy management and access tools.

What I’m thinking about

What you think, what you say, and what you do shouldn’t be three separate decisions.

See you next weekend,

Kevin