M&A is Down, but Not Out.

It's all about product-buyer fit.

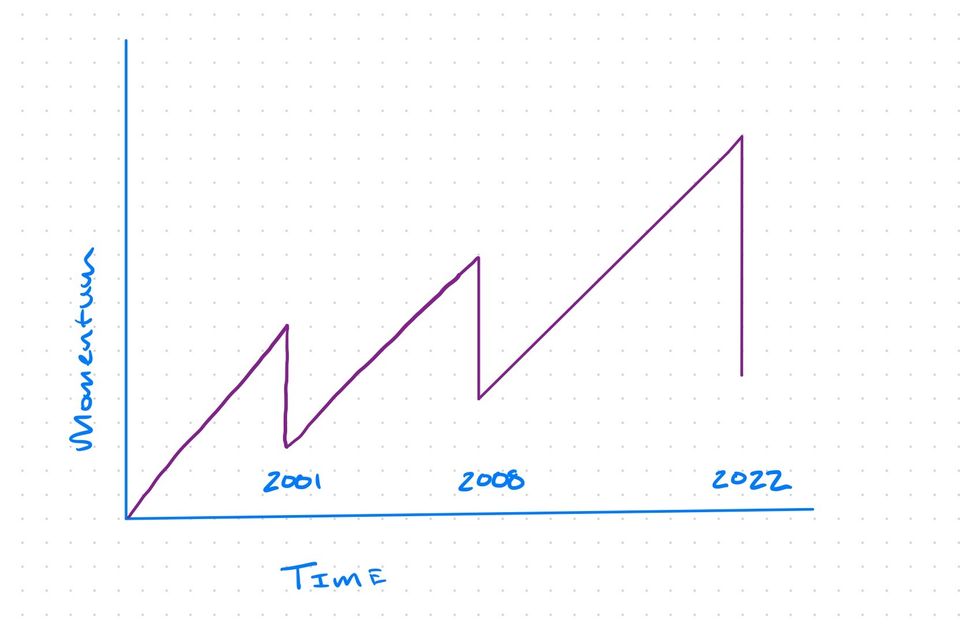

At the All-In Summit earlier this year, Bill Gurley used the analogy of a sawtooth to describe how risk works in markets. It looks something like this:

The takeaway is that risk builds slowly over time and the market gets into an increasingly “risk on” position over several years, but “risk off” happens almost overnight.

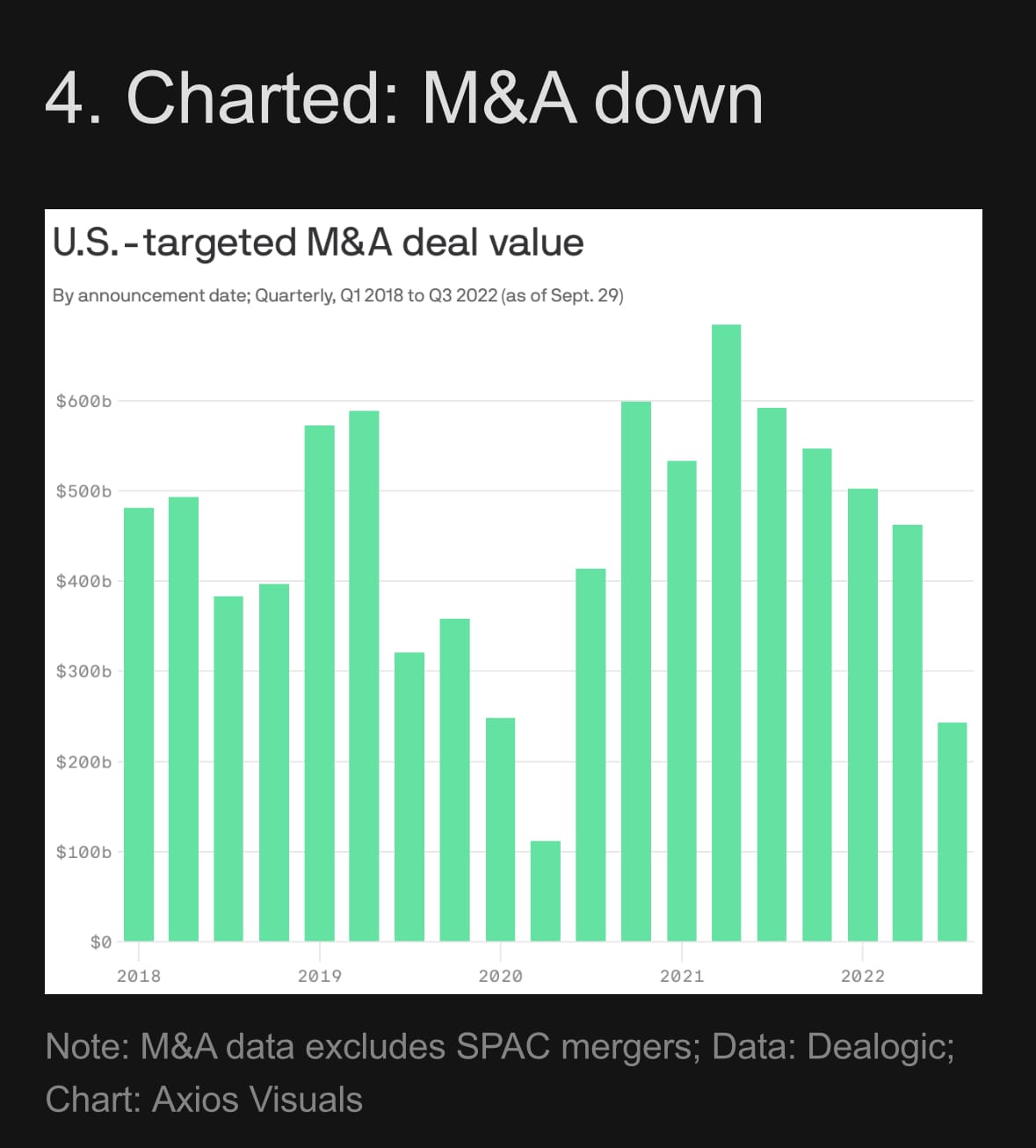

This isn’t just true of investing, but of all capital markets activity including at the micro level within companies- look no further than M&A.

M&A volume is down as capital costs rise across the entire market. Most firms are in a “risk off” posture and will likely continue to be for the foreseeable future.

The difference between “normal” market conditions and now is the evaporation of opportunistic buying.

When the market is up and capital is cheaper, firms are more likely to take risks on segments or technologies that take longer to become accretive to the company’s cash flow.

Now, larger firms will likely only buy products that are already on the strategic roadmap in the next 24 months.

Even then, it’s likely they’ll require those acquisitions to be cash flow accretive within the first 12-18 months.

For founders and executives that means efficient growth for the next 24 months is crucial if you eventually plan on being absorbed by a large or publicly traded company.

Additionally, now is the time to be exploring relationships and partnerships with those firms. By understanding their roadmap, and proving value now, it’s more likely you’ll be seen as critical to the future success of their business.

The good news is that for acquisitions that are still happening, companies are paying premium multiples if the strategic fit and operating profiles match the long-term needs of the business.

- Last month, Siemens acquired Brightly for 10.4x NTM revenue when current forward multiples for vertical software are ~8.0x but viewed the company as a natural fit for their continued expansion into software.

- Schneider Electric completed its full buyout of Aveva at an announced 9.2x LTM revenue, slightly above its trading value of 8.5x at the time. The full Aveva acquisition represented a 40 percent premium on the company's share price prior to the announcement.

Like any capital transaction that occurs in the next 12-18 months, headwinds exist within the M&A landscape. However, like any good sales process finding product-buyer fit is crucial and in these times it matters more than ever.

Thanks for reading Sustainable Returns! Subscribe for free to receive 1-2 posts per week.