Playing Offense in Energy: Four Trends to Count On

“Great leaders get back on their front foot faster.” - Coach K

I think about this quote a lot, usually in the context of bouncing back from rejection. After all, if you’re attempting anything hard, failure is the default state. You get knocked down, you get back up, you keep moving.

Today, I’m thinking about it differently—in the context of the Big Beautiful Bill. It’s moved the energy transition onto its back foot, for now.

Another quote that’s been top of mind comes from Ben Carson:

“I honestly think one of the reasons American exceptionalism exists is because we always buy the dip. It’s ingrained in us that things will get better. That optimism, channeled through the world’s most sophisticated financial system creates a virtuous cycle. When markets fall, Americans invest more.”

And then there’s this evergreen thought from Jeff Bezos, that’s one of the best I’ve ever come across for operating a business:

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’ And I submit to you that that second question is actually the more important of the two—because you can build a business strategy around the things that are stable in time.”

So in that spirit—playing offense and investing around what won’t change—I’ve been spending time thinking about the energy trends we can actually count on. The things that won’t change by the stroke of a pen and that are enduring for the next decade.

The AI-driven demand explosion isn’t slowing down.

Data center electricity consumption is projected to more than double by 2030, reaching around 945 terawatt-hours globally. That’s equivalent to Japan’s entire annual electricity consumption today.

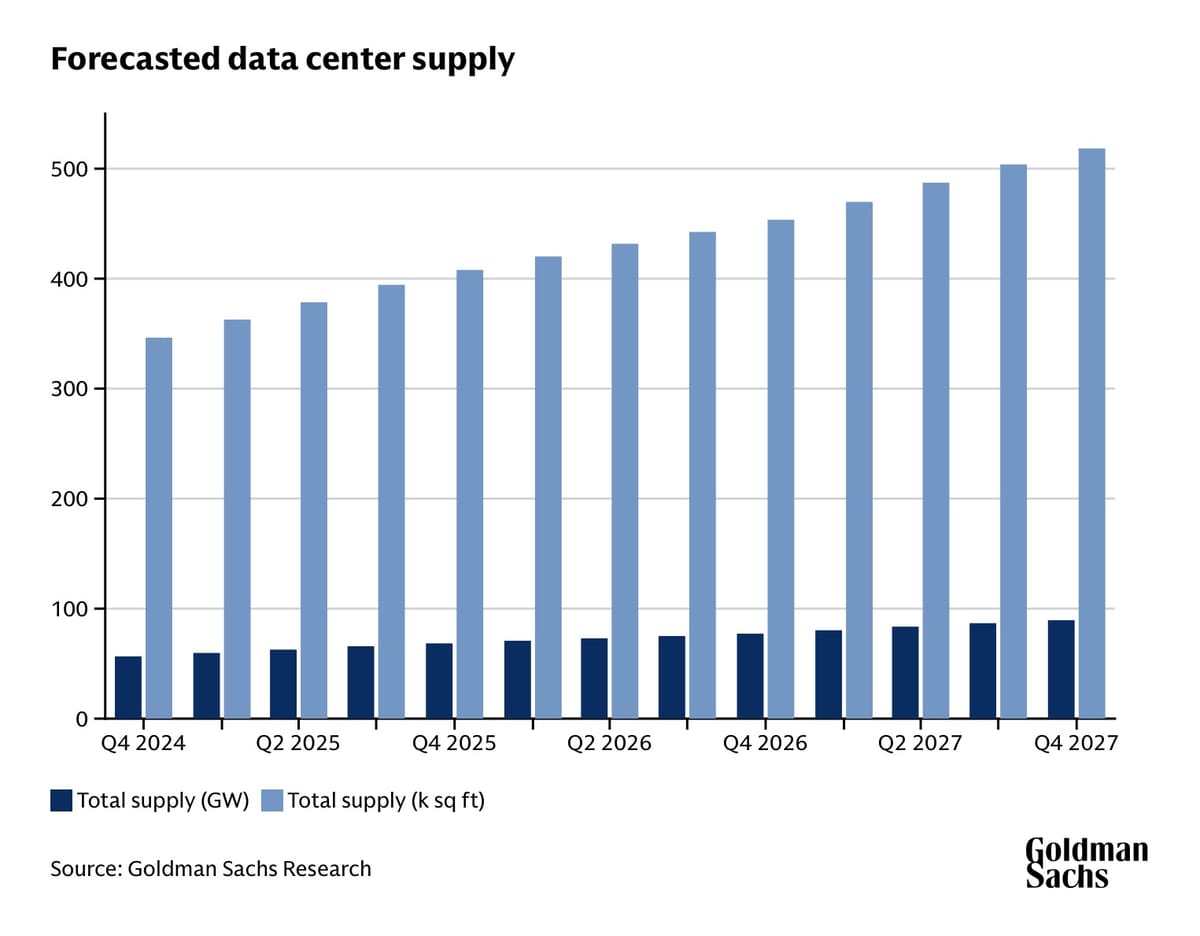

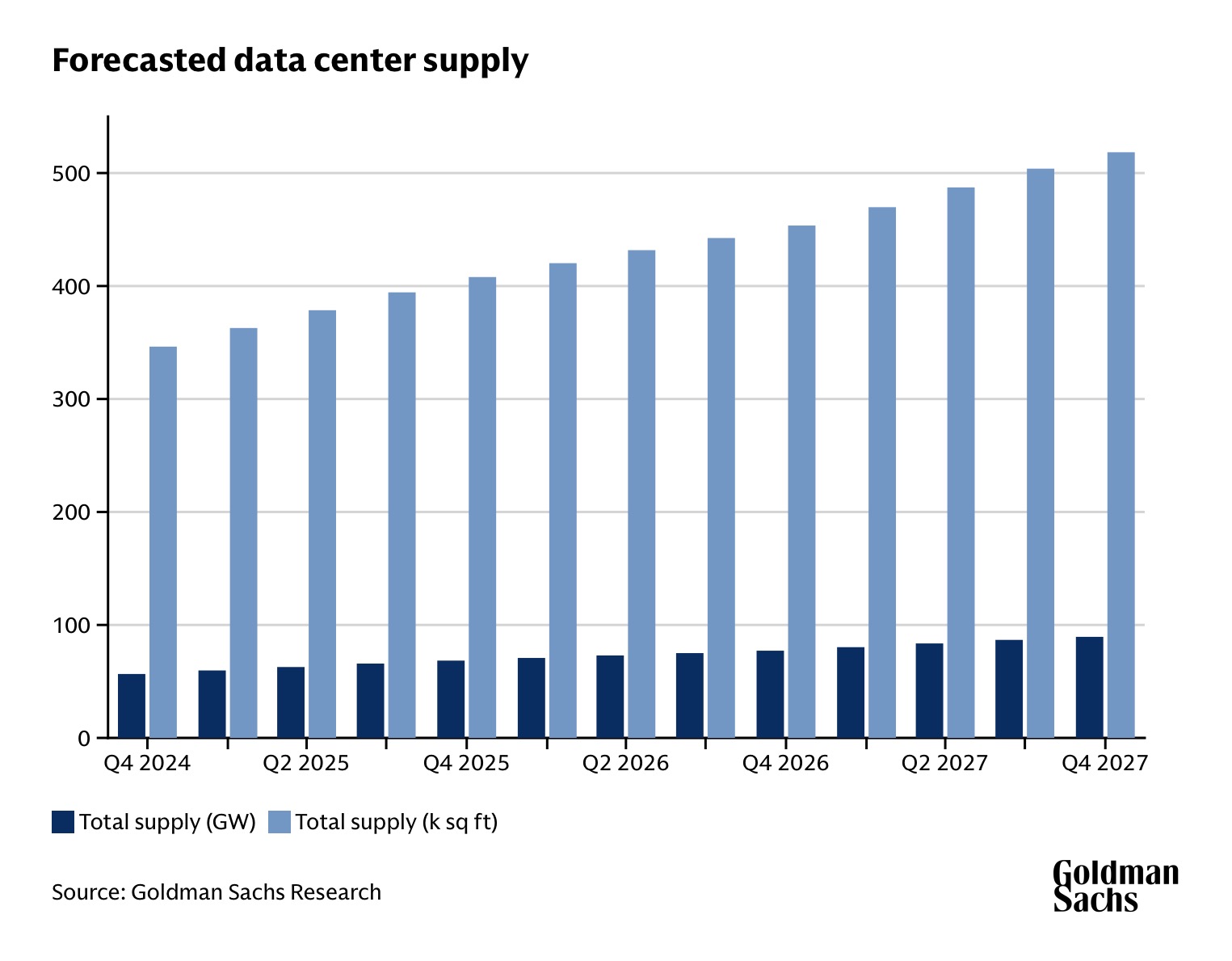

Goldman Sachs forecasts that global power demand from data centers will increase 50% by 2027 and potentially 165% by the end of the decade compared to 2023. In the US, data centers are on course to account for almost half of the growth in electricity demand between now and 2030.

Volatility creates complexity; complexity creates opportunity.

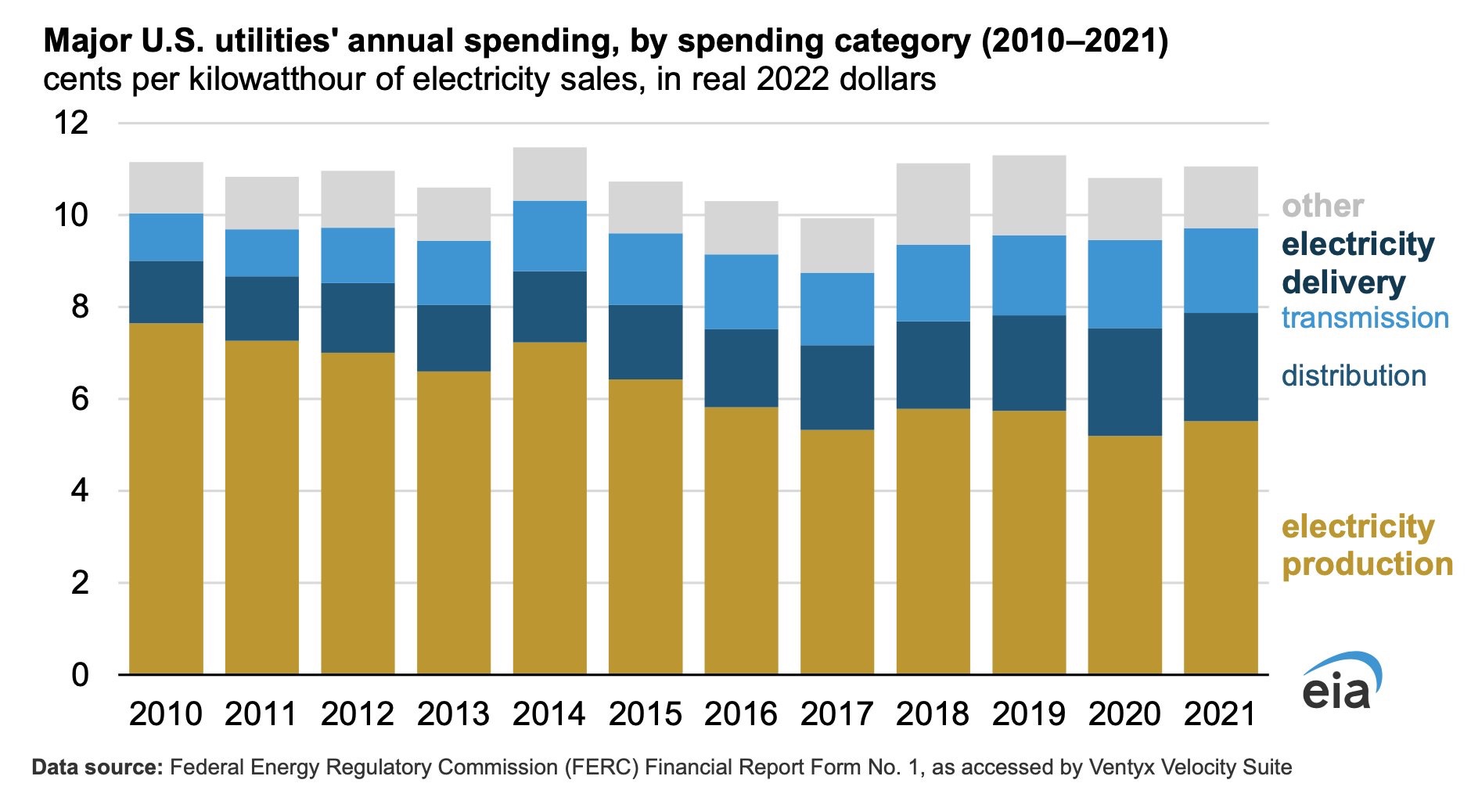

We’re living in a world of permanent volatility now, and customers have more options than ever. Southern California had negative wholesale rates 15% of the time in 2024, a 3x increase from 2023. Yet, customers there spent 16% more on their bill year over year due to record heat and inflation. Europe tells a similar story, negative wholesale power prices rose by 8%, but bills climbed. And it’s not just supply, ERCOT wants to make a $30B investment in transmission in Texas as T&D charges across the country now make up almost 45% of bills.

Meanwhile, microgrid adoption is growing, demand response is getting easier, and customers now have a multitude of options across other options to lower reliance on the grid or take advantage of the growing volatility in prices. Speaking of prices…

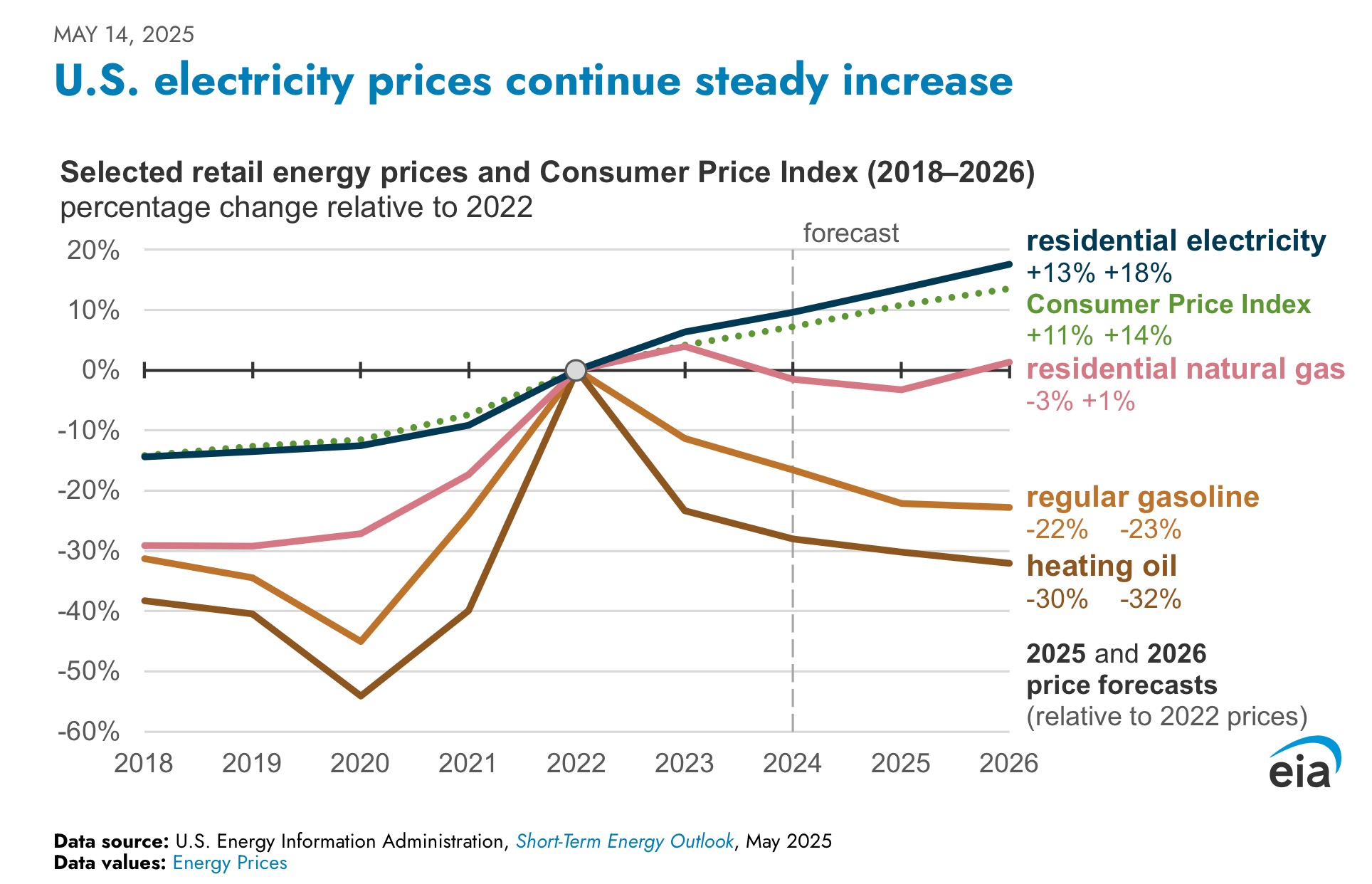

Higher prices are coming.

The average annual electricity bill rose almost 5% over the last few years, double the pace of inflation. The Big Beautiful Bill makes it harder to bring renewable generation online and natural gas plants take longer to bring online due both to construction times and supply chain bottlenecks.

So, the math here is simple, more demand and less supply equals higher prices. That could manifest itself in higher energy prices or lead to more customers looking for alternatives: microgrids, building automation, demand response, distributed generation. I’d bet on the latter.

We need to get more out of existing infrastructure.

If demand explodes and new supply takes forever to connect, we need to squeeze more out of what’s already there. That means extending plant lives, bringing retired assets back online, and optimizing what’s currently built.

That’s an opportunity for the already large O&M space. Utilities spent $17B maintaining the distribution systems alone in 2024. That number is poised for growth - the average age of the installed base is forty years old, with more than a quarter of the grid fifty years old or older. The average age will only go up over time.

You can’t legislate away supply and demand. AI demand isn’t stopping. Grid bottlenecks aren’t magically disappearing. Customers aren’t going to accept higher bills without finding alternatives.

There’s real opportunity is in building around what definitely will happen and the faster we get back on our front foot, the better.