Playing the Long Game: Productivity for Sustainable Investing Success

Skillfulness takes time, and life is short. When I first came across the Latin phrase "ars longa, vita brevis," it struck a chord within me.

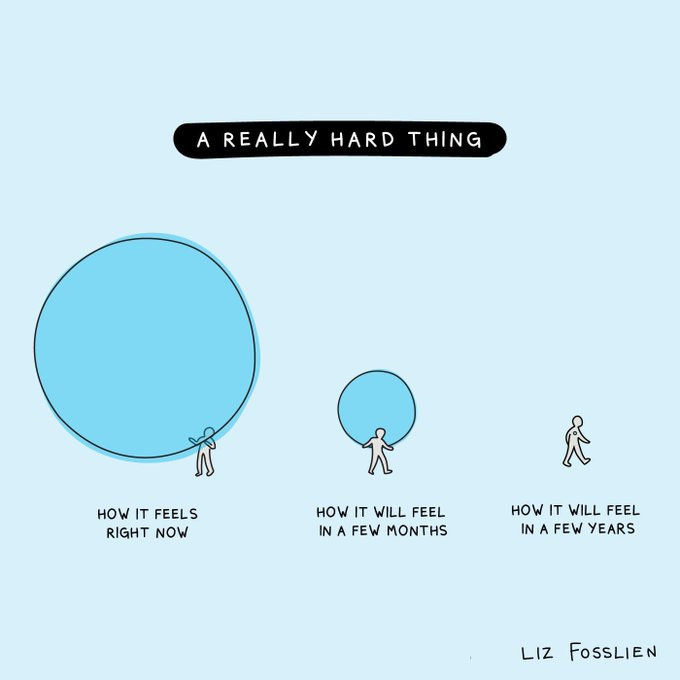

In the world of investing, it can take five years, and often closer to seven or ten years, before you can honestly gauge your skill level. Such a lengthy feedback loop can lead to detrimental personal and team behaviors, especially for those who thrive on seeing quick, tangible results—the classic Type A personalities.

Thanks for reading Kevin Stevens! Subscribe for free to receive new posts.

The unique time horizon in investing renders most conventional productivity tips useless. The measure of success lies not in how much you accomplish in a single day, but rather in positioning yourself and your investments for sustained success over the years.

Maintaining enthusiasm and motivation is easy when the market is thriving—new investment opportunities emerge seemingly daily, existing investments secure new contracts quickly, and companies rapidly expand their workforce all making success seem inevitable.

But what happens when the market slows down? How can we avoid performance art productivity? That’s where I want to focus today - on techniques we can all use to set ourselves up for success in both the good times and especially the bad.

Embrace the Journey

First and foremost, it’s impossible to be a great investor if you don’t relish the process of uncovering actionable theses and great investments. Curiosity is one of the most important elements to success in investing, and it doesn’t stop at the first level of depth.

As Charlie Munger famously said, "The will to prepare is more important than the will to win." Preparing diligently and building a solid foundation of knowledge and expertise is paramount in investing. The work you put into research and analysis may not yield immediate results, but it is crucial for long-term success.

Naval Ravikant echoes this sentiment by highlighting that the best work feels like play. Finding joy in the process of researching, analyzing, and making investment decisions is key to sustaining productivity and wealth in the long run.

This step is where I’ve found writing to be the most helpful. One, it’s a tangible output of the work of research and analysis. Two, good writing gives bad thinking nowhere to hide. Three, writing always helps us discover new ideas in the process.

Create Momentum

As humans, we often struggle with long-term and ambiguous goals. We start a new endeavor with excitement and motivation, but as we move further away from the starting point, progress tends to slow down or come to a halt. This is called the plateau effect.

The flipside of the plateau effect is the goal gradient effect which states that the closer we get to a goal, the more likely we are to complete it.

Breaking down larger experiences into smaller manageable subgoals is a powerful strategy because it leverages the best of both concepts. This approach, known as narrow bracketing, helps us maintain focus and motivation by dividing the journey into digestible parts. It eliminates the middle while keeping us closer to the end of goals.

As an example, let's say your goal is to raise a new round of funding for your company within the next year. Such a goal requires multiple mini-steps for achievement. Setting smaller goals that create a sense of momentum is vital. For example, in the first week, commit to building a pipeline and CRM. In the second week, groom the CRM and create a top 20 targets list. Continue breaking it down into achievable tasks week by week.

I've used a simple "X" in a square to mark completed tasks for both professional and personal goals (see above). Combined with bite-sized goals, this practice establishes a sense of habit and momentum that I never want to break.

Productivity with Purpose

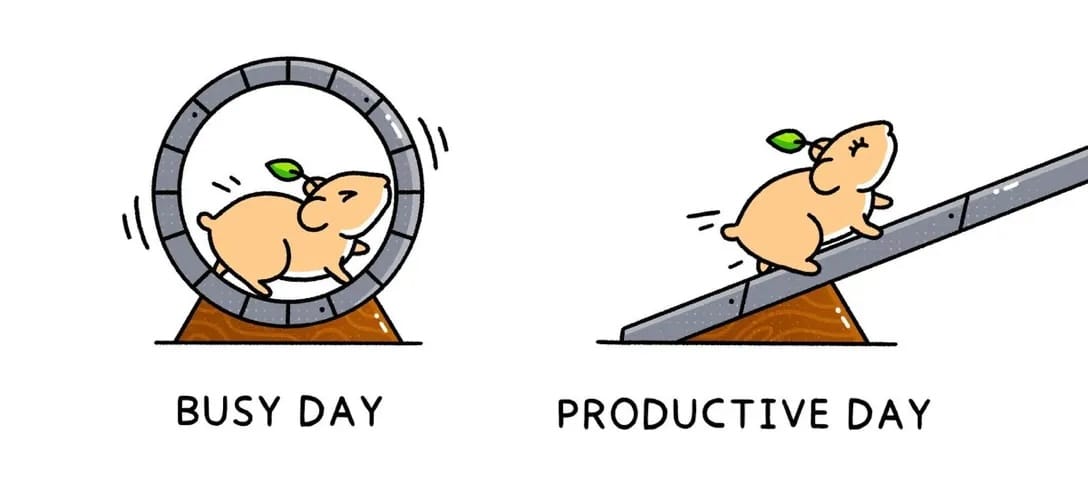

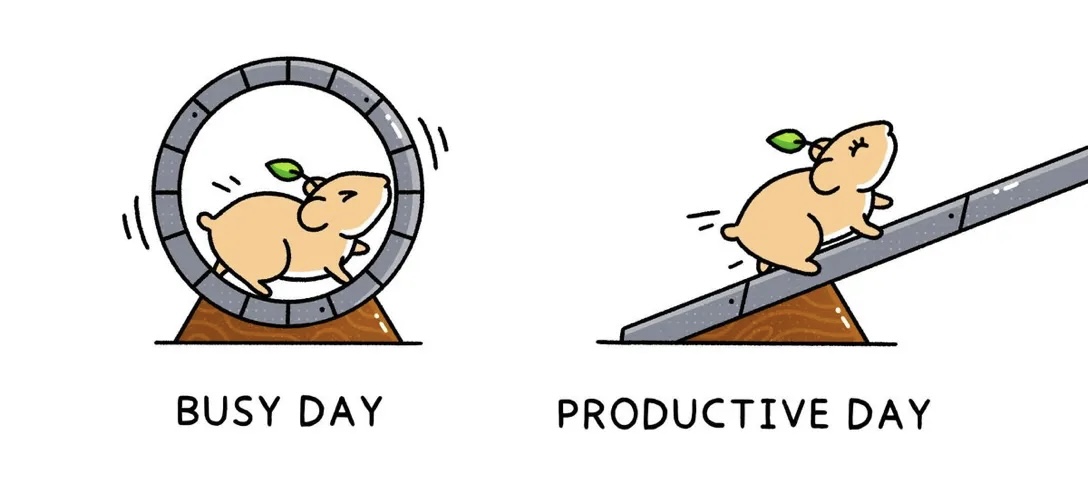

Defaulting to productivity for the sake of being busy is a common trap, even in investing. However, the most dangerous type of productivity is one that feels productive but fails to move the needle significantly. Avoid getting caught up in low-leverage tasks that provide a false sense of progress.

Cal Newport introduces the concept of "slow productivity" and advocates for shifting our time scale from days and weeks to months and years. The goal is to maximize meaningful accomplishments over the next five years, rather than fixating on short-term gains. Think of it as choosing nutrient-dense tasks over low-calorie junk food—the former sustains and nourishes you in the long run and the other creates short-term happiness at the expense of long-term results.

I've found myself falling into this trap numerous times. Given my background as an operator, I tend to prioritize tasks that provide a tangible sense of productivity and immediate visible results. However, I've come to realize that this approach can sometimes lead me astray, as it may not necessarily align with my long-term objectives.

With each new task or project, ask yourself “is this necessary and is it moving me to a goal I need to achieve?”

Successful investing demands a disciplined approach and a focus on the long game, even when it feels the hardest to maintain. Unfortunately, most productivity advice tends to prioritize efficiency and immediacy. However, there are times when it's essential to slow down to speed up. These frameworks I've shared have become my go-to tools for realigning with long-term thinking and prioritizing pragmatism over impulsive reactions.

Thanks for reading Kevin Stevens! Subscribe for free to receive new posts.