Power Prices Rise…Again

A few weeks ago, I wrote an article on four trends we can count on in energy over the next decade. Two of the trends that I thought would be certain were higher prices and the need to get more out of existing infrastructure.

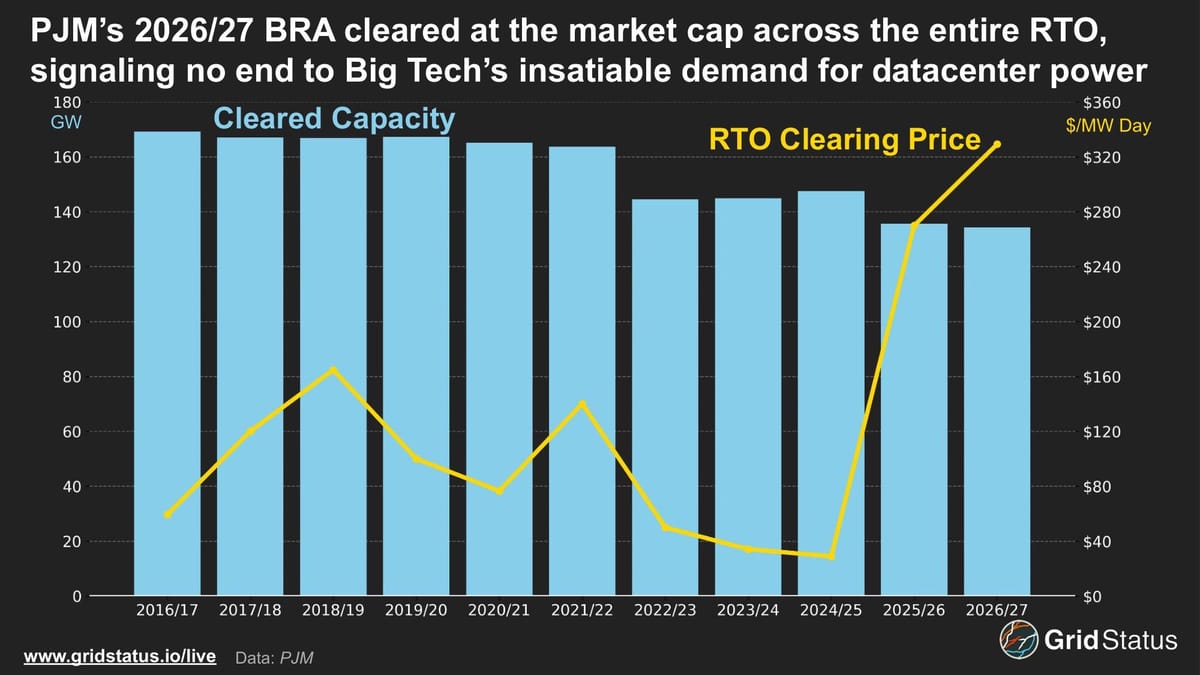

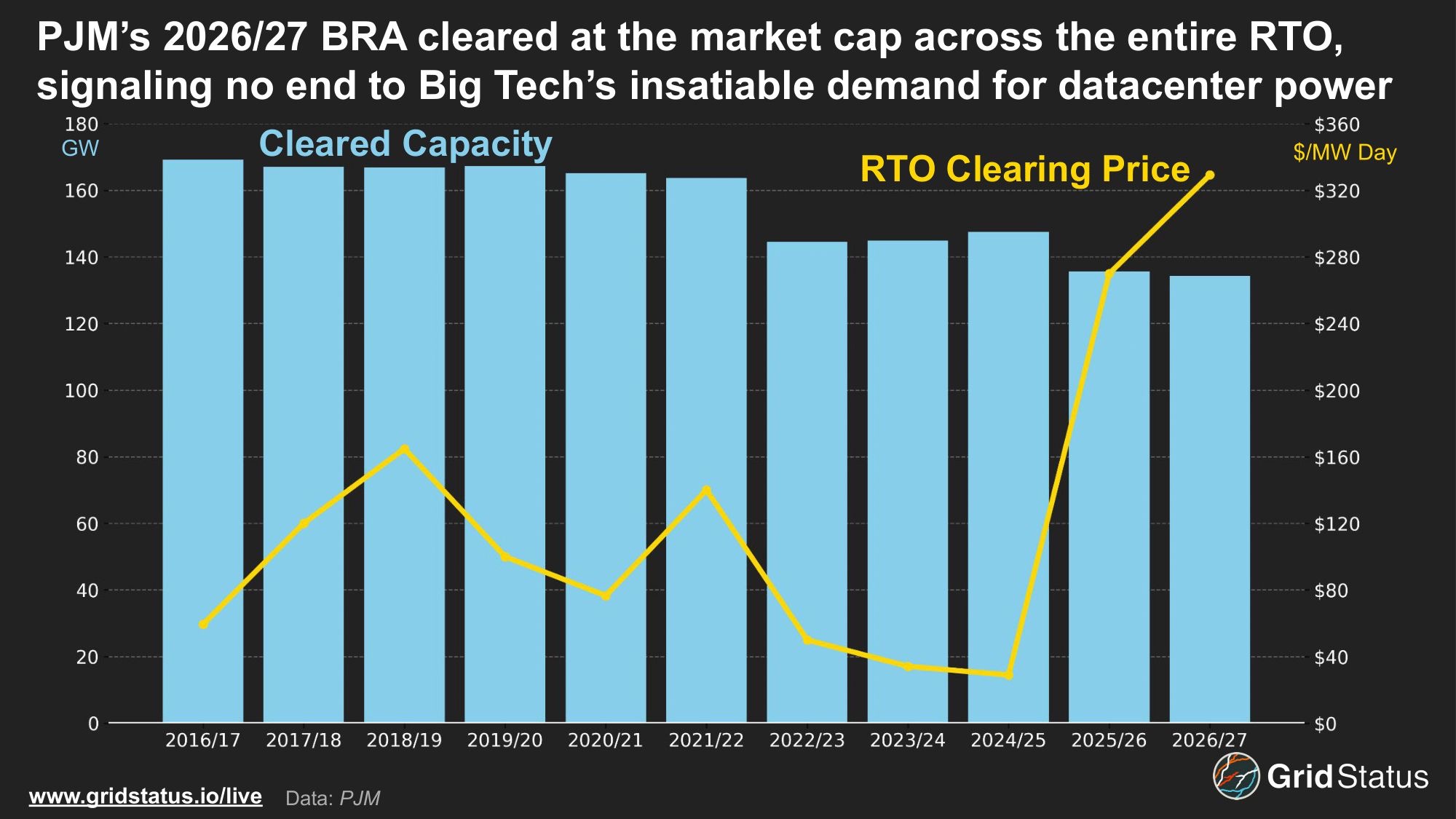

In an event only energy nerds track, PJM released the results of its annual capacity bidding process yesterday and the results were, as expected, higher energy prices.

The final numbers came in at $329.17 per megawatt day, a 22% increase over 2024 which was an 800% increase from 2023. PJM will pay power producers $16.1B to meet its energy needs from June 2026 to May 2027. Consumers across PJM are likely to see a 1-1.5% increase from the results of this auction.

Lost in the shuffle of these results is the fact that PJM is slated to retire 15-30% of generation assets between now and 2030. That almost certainly can’t happen if the results of capacity markets continue to rise at this rate.

Power prices have outpaced the CPI by more than double over the last 12 months - 5.6% vs. 2.7%. The ROI calculus of onsite power generation is changing rapidly and it will have big implications for microgrids, utilities, and even the much-beleaguered solar industry as customers become less likely to rely solely on a grid that no longer delivers electricity cheaply and reliably.