Revenue Retention Recedes

We’re finding out who’s mission-critical and it’s their time to shine.

Revenue quality provides the surest hint to a business's long-term success. If your customers love you and can't run their business without you, it will show up in gross and net dollar retention. It's the first metric I look to when evaluating opportunities.

Both of those are down considerably across software. Industrial and climate software has proven resilient, but keeping and growing customers is more challenging than ever.

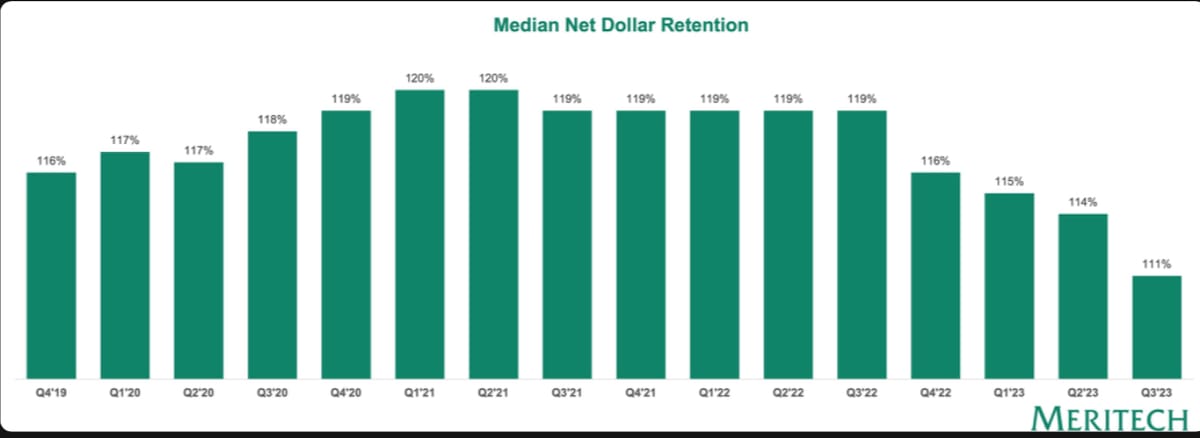

Median net dollar retention peaked in public software companies in the first half of 2021 at 120%. Since then, they've declined, with 2023 being noticeably tough.

In 2022, customers took an axe to software budgets. They resized any oversold contracts and eliminated most things deemed non-critical. As a result, we witnessed (and still are witnessing) software companies right-sizing their sales and marketing and customer success functions.

Mission-critical software separates itself from the pack in times like these. The very best companies in the private markets remain around 115-120% NDR with very little logo attrition.

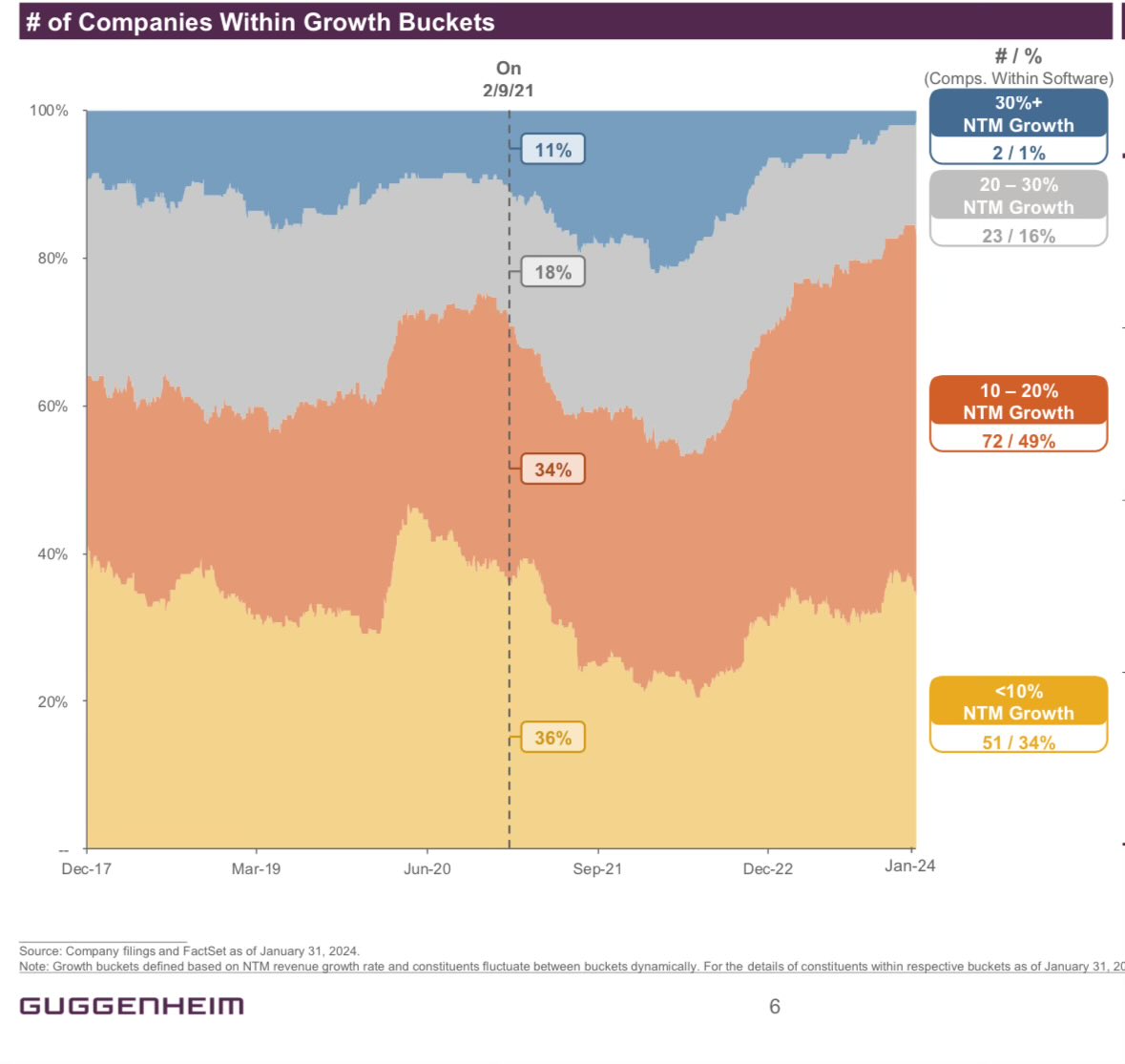

This "built-in" 20% growth looks much better when the market returns to reality. In 2021, over 20 companies in the public market had 30% annual growth. Today, that number is 2. A high NDR makes it easier to enter this select group.

So, what tactics do the companies with the highest retention rates deploy? I've seen three that stand out:

- They get ahead of it. When it's time, the best companies go to their customers and exchange longer term contracts for discounted rates. If a customer expanded by 25% last time, they'll come back with a smaller bump but lock in an extra year.

- They understand the difference between asking for and willingness to pay. This applies to both new features and contract renegotiation. Every customer will renegotiate in down turns, but great teams understand the importance of the discount to keep the customer. They apply this same mindset to new product features. Will a customer pay more for this, or is it just a nice to have?

- They operate customer success with precision. Not only do they have leading engagement metrics locked in, but they are out in front of the customer ahead of time. While others may cut their customer success teams, the high NDR companies leverage them like a surgical instrument.

It’s much easier to build a business below the top line when you have more certainty on the top line. High revenue retention numbers enable accurate budgeting, a priceless advantage in times of tighter capital markets.

It’s also a chance for mission critical (and sometimes lower growing) softwares to differentiate themselves. Investors still love their 100-200% annual growers, and so do I. But, there’s something special at scale about the business that grows 30% and rarely loses customers regardless of cycle. It’s their time to shine.