Kilowatts and Capital 11.09.2024 - Interest Rates or Policy: What's More Important to the Future of the Energy Transition?

New format alert! Over the last few weeks, I’ve taken a step back from writing as regularly to think about what I want to share here and how I want to do it.

Inspired by some of my favorite writers and newsletters, I’ve settled on a new format to share my thinking and a few market data points.

Moving forward, I’ll post here every Saturday morning and include:

- ~500 words on a topic I’m thinking about

- 2-3 links to the most interesting articles I read

- an energy transition weekly market recap

The best posts I write will make it over to an archive on my personal website.

I’d love to hear from you on what you think about this format and what you’d like to see as I continue to evolve on what I share here.

Interest Rates > Policy

It’s hard to avoid talking about the election, especially when it comes to the energy transition. While I try to steer clear of the political noise, a quick assessment of how policy could impact the energy sector sparked some discussion on X, so it seems worth sharing my thoughts here.

I’m not a doomer—I’m an optimist by nature. I prefer to approach challenges with a sense of pragmatism and a belief that solutions will emerge from people genuinely trying their best. And that’s the approach I’m taking in this post.

Despite some encouraging policy tailwinds (and headwinds, looking at you permitting and interconnection) over the last two years, the climate tech and energy transition sectors have faced tough times. We’ve seen multiple headlines about layoffs and bankruptcies. The funding landscape has notably slowed, with investment levels falling significantly.

That said, it’s not all doom and gloom. There are bright spots: utility-scale solar is booming, battery storage adoption is accelerating, and electric vehicle (EV) sales continue to rise, despite some negative headlines to the contrary. What do these technologies have in common? Their economics make sense.

One key reason for the continued growth in these areas is that some of the most sophisticated investors in the energy transition are focusing on technologies that are “policy agnostic”—meaning their success doesn’t depend on government incentives or regulations. Scott Chan, CIO of CalSTRS, put it well in a Pitchbook interview: “If I looked at our portfolio around the energy transition…we wanted to make sure that it wasn’t dependent on any policy moves.”

Investors like CalSTRS and infrastructure developers don’t think in years, they think in decades. As a result, economic competitiveness matters and if a project is economically sound it can weather any political storm. This is crucial for long-term sector stability.

So, here’s my contrarian take: the biggest risk today isn’t political change—it’s interest rates.

Beginning in March 2022, the Federal Reserve raised interest rates 11 times (from 0 to 5.5%) in response to inflation. These rate hikes have had a direct impact on infrastructure investment. As a result, investment in infrastructure—like energy transition—has slowed dramatically.

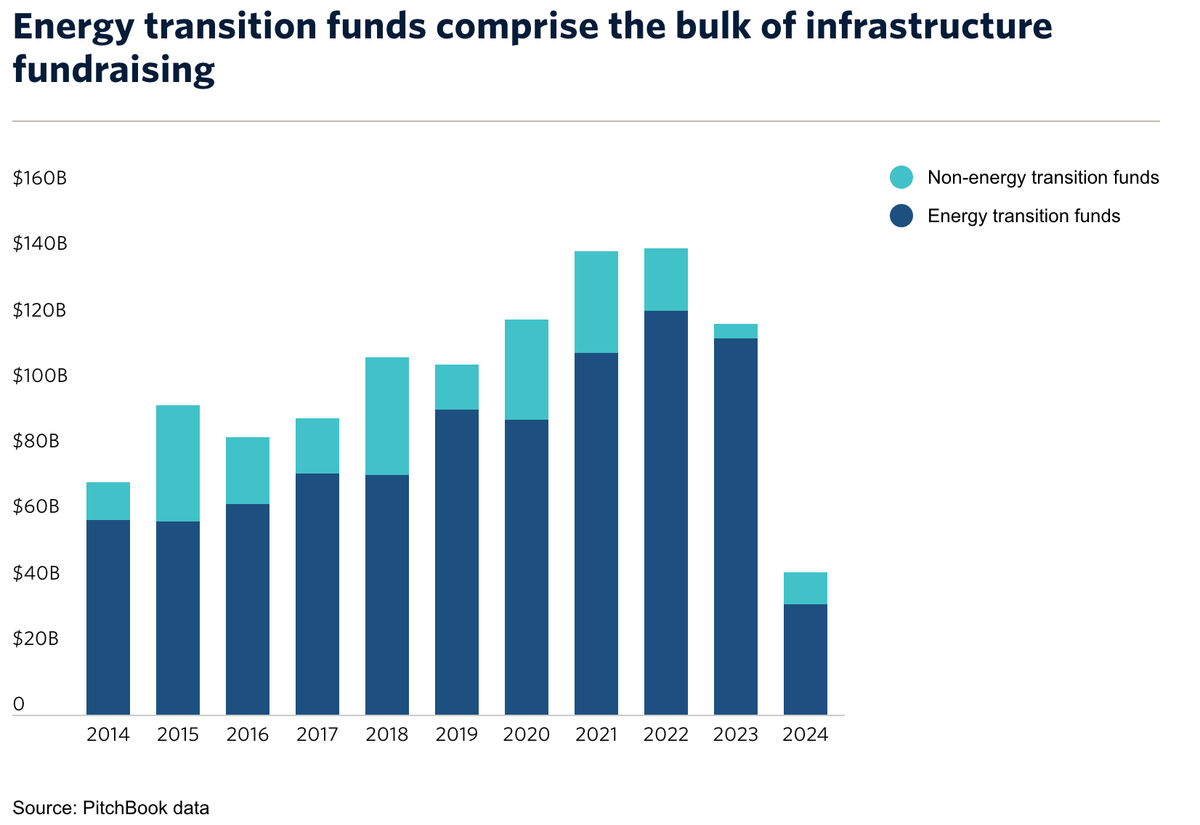

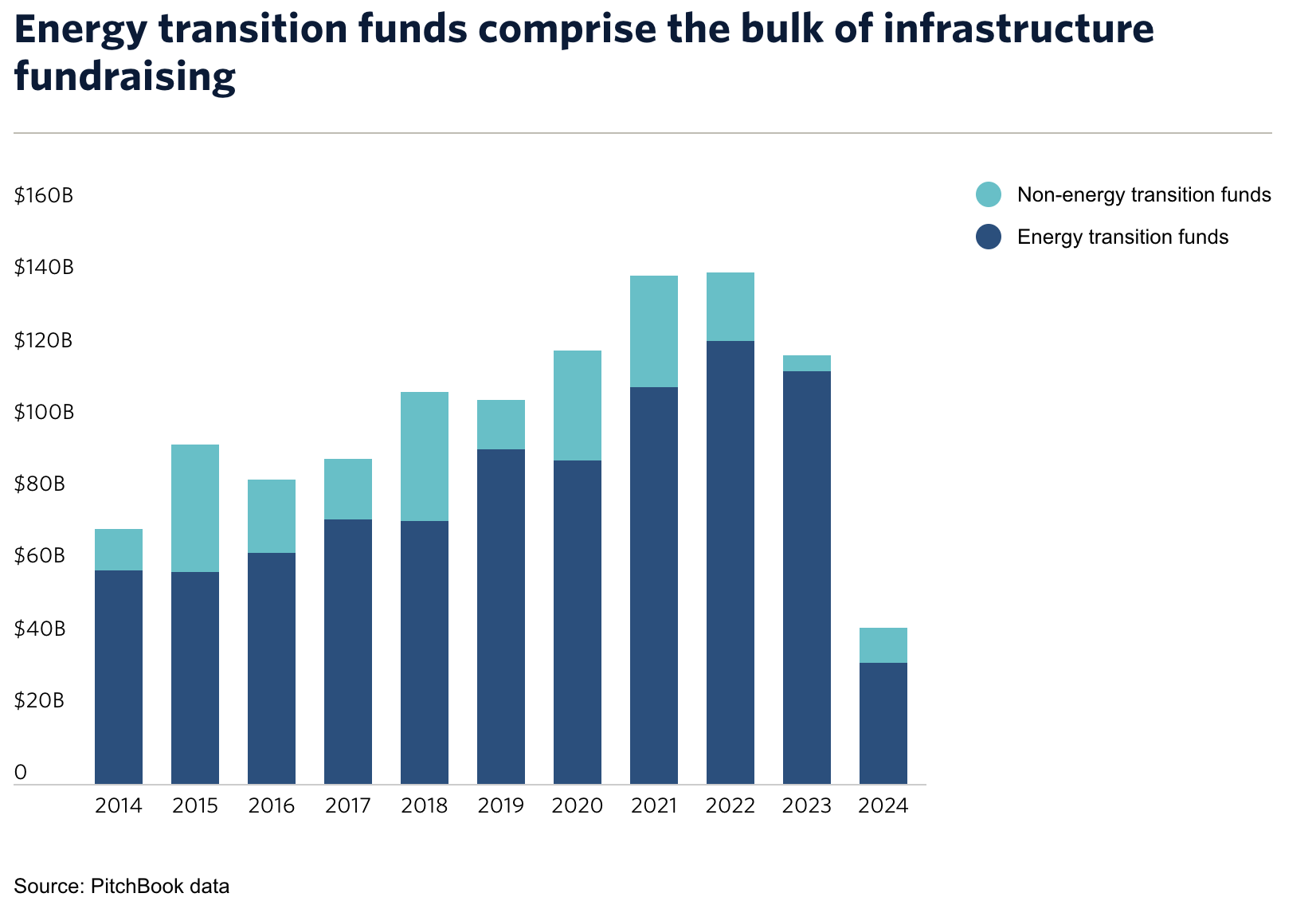

Infrastructure funds raised $140 billion in both 2021 and 2022. In 2023, that figure dropped to $100 billion, and in 2024 it is expected to fall further, to around $80 billion. Sure, there’s some policy uncertainty mixed into these numbers but the correlation with interest rates is too big to ignore.

While certain policies proposed by Trump might increase government debt - and 10-year bond rates - that’s not a uniquely Trumpian problem. Both parties have contributed to the deficit which is what’s scaring the market. Regardless of who’s in office, the key issue here is that higher interest rates drive investment decisions at scale more than policy.

This election could feel like a setback for the energy transition, especially for sectors relying on government funding or favorable regulatory environments. However, the positive side is that many energy technologies today are already competitive on pure economics, independent of government policy.

It also means they are more susceptible to market forces AND more predictable based on how those forces move. That’s a great signal for the long-term viability of the transition.

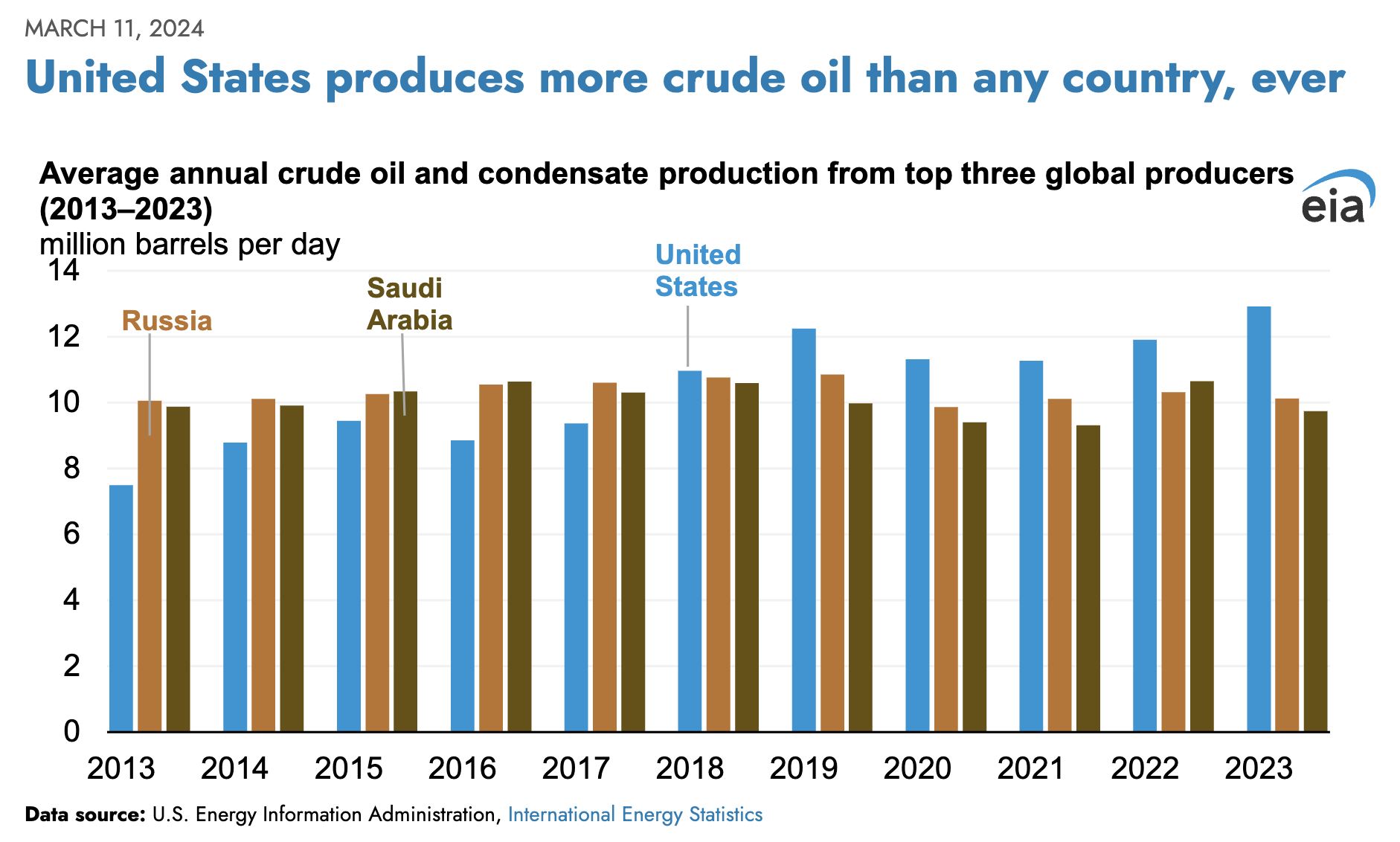

One last note, this all happened while the US drilled more oil and gas than any country, ever. So, even while facing record competition and elevated interest rates several energy transition technologies flurished.

Over time, this will attract more capital—both public and private—regardless of which political party is in power. That’s what really matters when you’re focused on decades not years.

Signal Check

Capital Markets Report from KeyBanc and Sapphire Ventures: I enjoy comparing energy transition and industrial software to generalist reports because the market is so different. Here, gross and net dollar retention stood out. Those median numbers have dropped to 91% and 101%, respectively. If you sell to real-world industries like utilities and industrials with these metrics, you’d eventually go out of business. You can’t survive the long sales cycle only for customers to barely expand beyond their initial contract.

Assessing Corporate Venture Capital, Sovereign Funds and Green Energy: It’s important to read things that challenge your thinking and this post from a famed NYU professor did just that. All great businesses require relentless focus on a north star and failure reallocates resources appropriately in healthy markets. What happens when you have neither and how does that impact performance? I don’t agree with everything here, but the main points are worth consideration.

Market Pulse

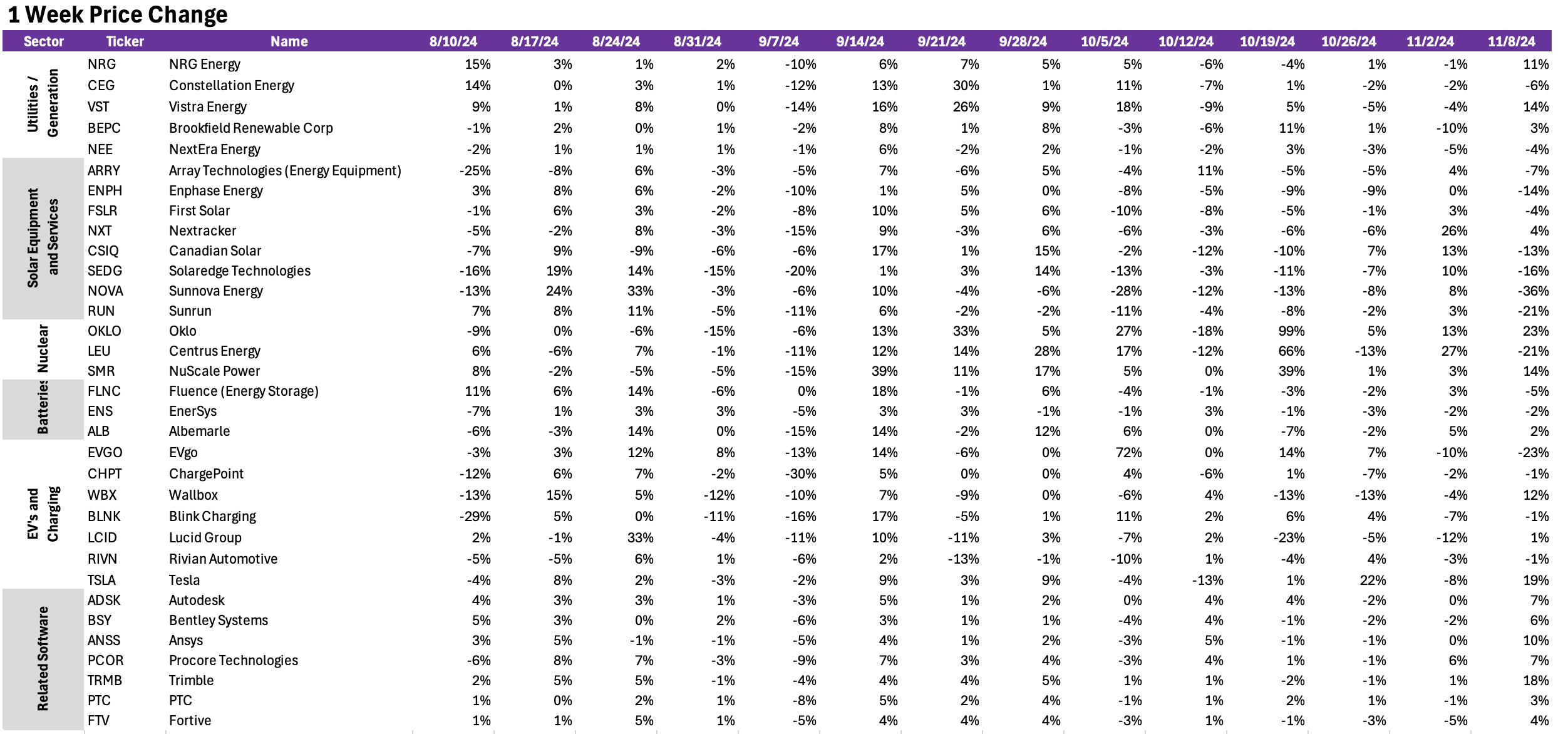

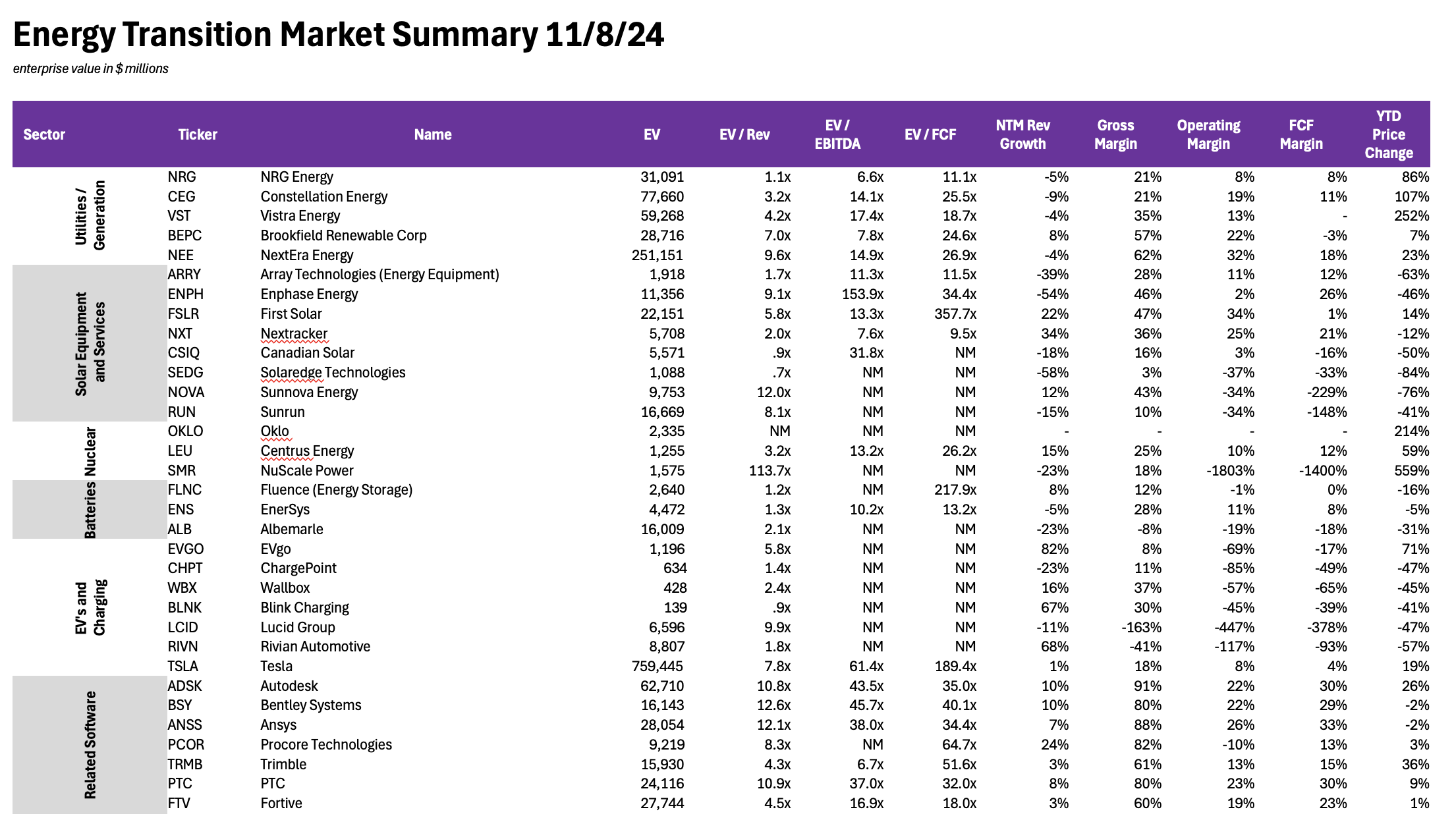

Each week, I’ll share a non-exhaustive, but representative list of energy transition stock performance and trading data here.

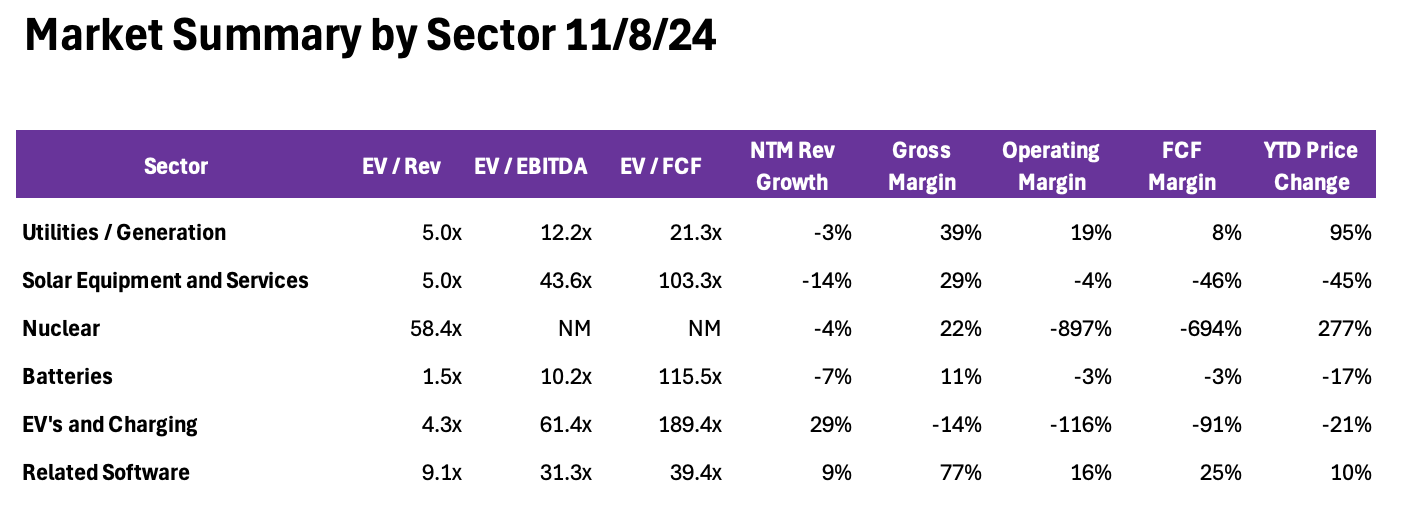

With the election and earnings in the same week, it was a volatile week for some of the most recognizable stocks. Solar saw the biggest slides while EVs and software both saw significant gains.

Sources used in this post include Pitchbook and company filings.

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Energize Capital. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.