Kilowatts and Capital 11.23.2024 - ServiceTitan Files for IPO

Northvolt received all the coverage, but this one is just as important.

ServiceTitan filed its S-1 to go public this week. For obvious reasons, the move made waves in the venture capital world. But we should pay attention in the energy transition world, too.

If you’re unfamiliar, ServiceTitan is the largest software for trade industries like HVAC and electricians - two industries with major tailwinds related to the energy transition and crucial to building electrification.

The company covers all workflows in an end-to-end way, ranging from the moment someone clicks on a customer’s website, to the scheduling of the dispatched technician, to the GPS pings from the technicians’ trucks en route to a job, down to financing decisions and payment.

Since the energy transition touches a lot of the trade industries and depends on them for success, the ServiceTitan IPO can serve as a guide to what success can look like for software serving the people in the field.

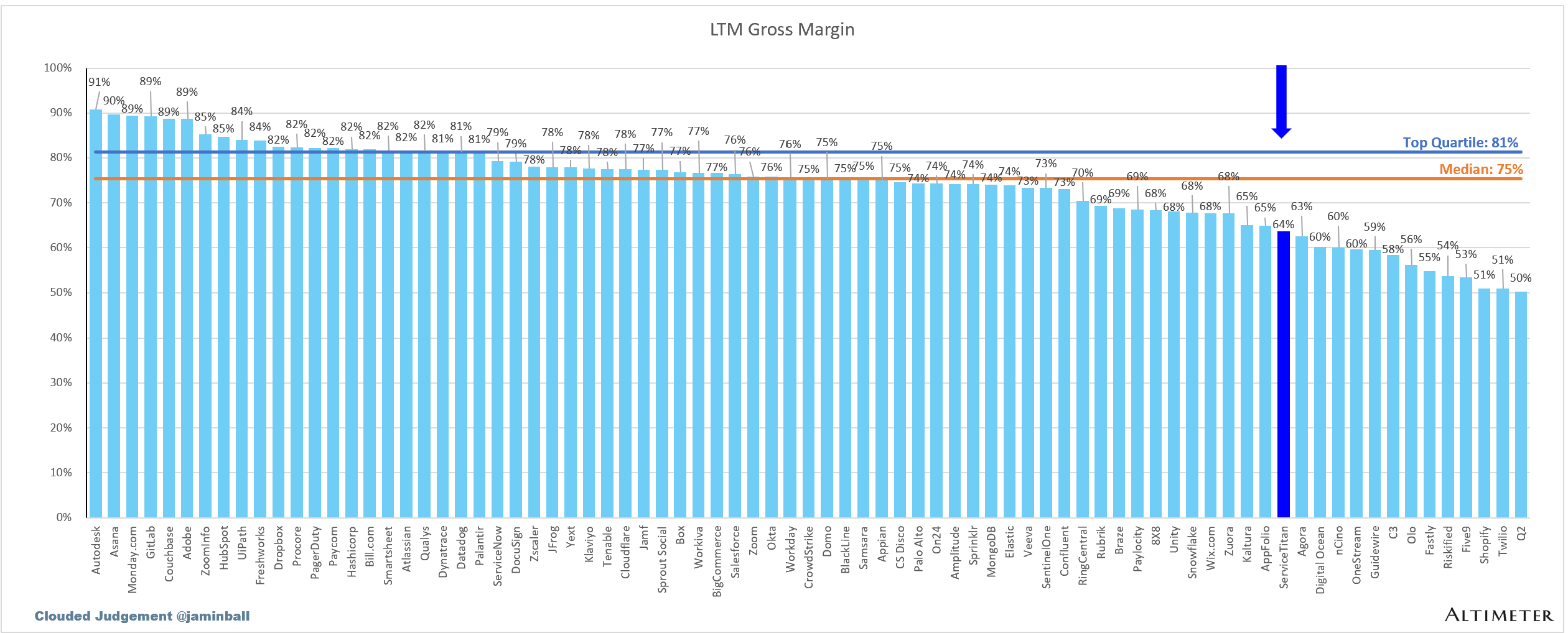

Gross Margins

ServiceTitan’s lower gross margins will be a topic of discussion among public market investors. But, when it comes to industrial software, “lower” gross margins are common.

These customers adopt software differently and at slower rates than other sectors. As a result, industrial software usually has some form of services component to ensure proper onboarding and user engagement post-launch.

I think there are 3 reasons to be bullish on this metric increasing over time.

- All industries and customers are becoming more digitally native

- The “professionalization” of trades by private equity

- Software becomes a larger part of the revenue mix through feature expansion

Finally, low gross margins due to services aren’t inherently bad especially when they increase GDR and NDR and that can definitely be the case in industrial and energy tech. That brings me to point number 2, retention.

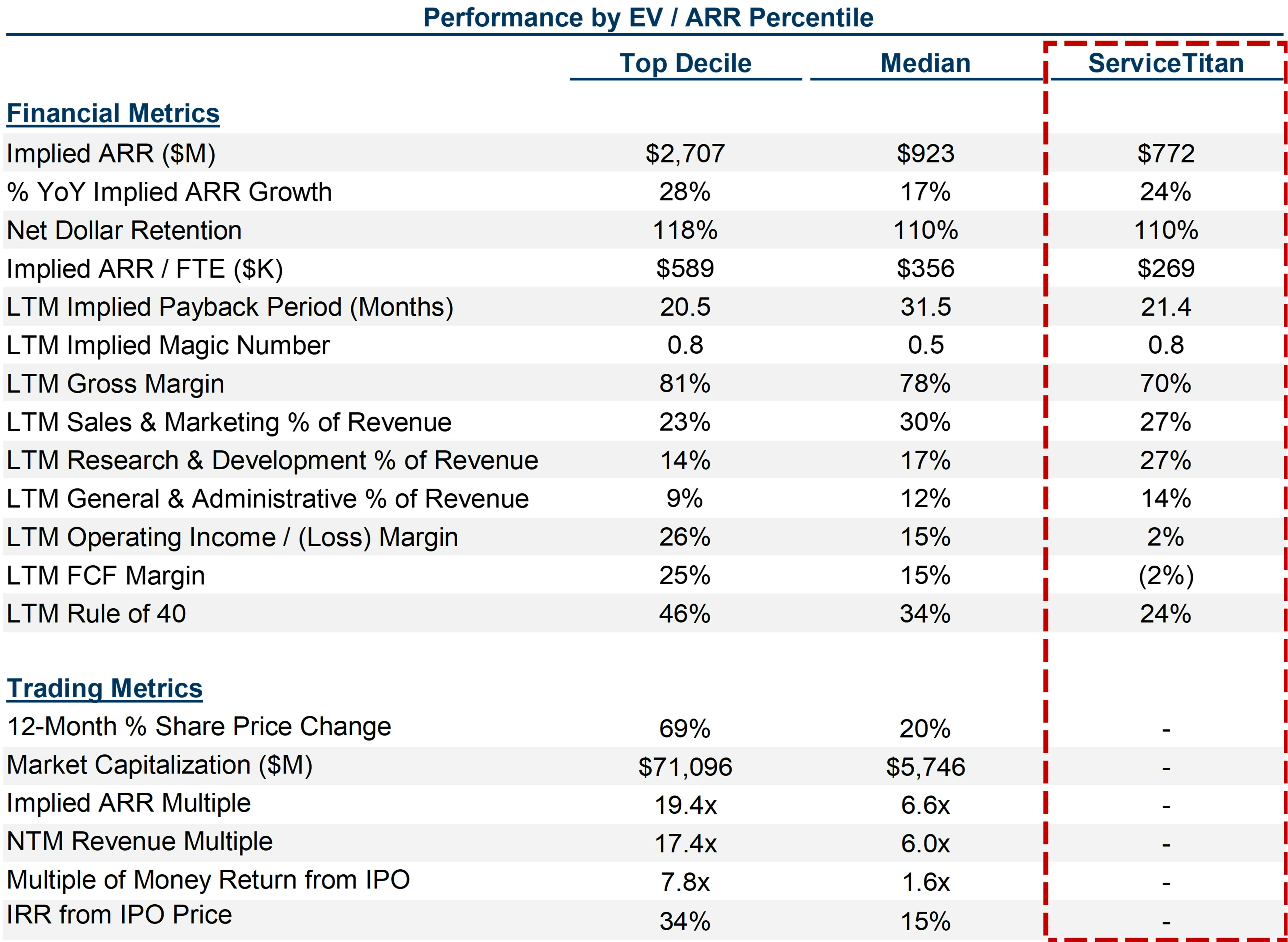

Net Dollar Retention

ServiceTitan’s NDR is a tale of two stories. According to KeyBanc, top quartile NDR has slipped to 109% among privately held software companies in 2024 and the median public number is currently 110% among those that report the metric.

At 110%, ServiceTitan sits right in the top quartile or median depending on how you look at it. However, given the big services component, I’d like to see a higher NDR here. Between GDR and NDR, you really get a sense of the ROI on services.

I suspect ServiceTitan’s retention metrics are hurt by the long tail nature of their customer base. It’s difficult to keep 8,000 customers happy and expanding.

The problem, however, is that you can’t have low GMs and median retention. The services that drag GMs down need to show up in customer stickiness and here they don’t.

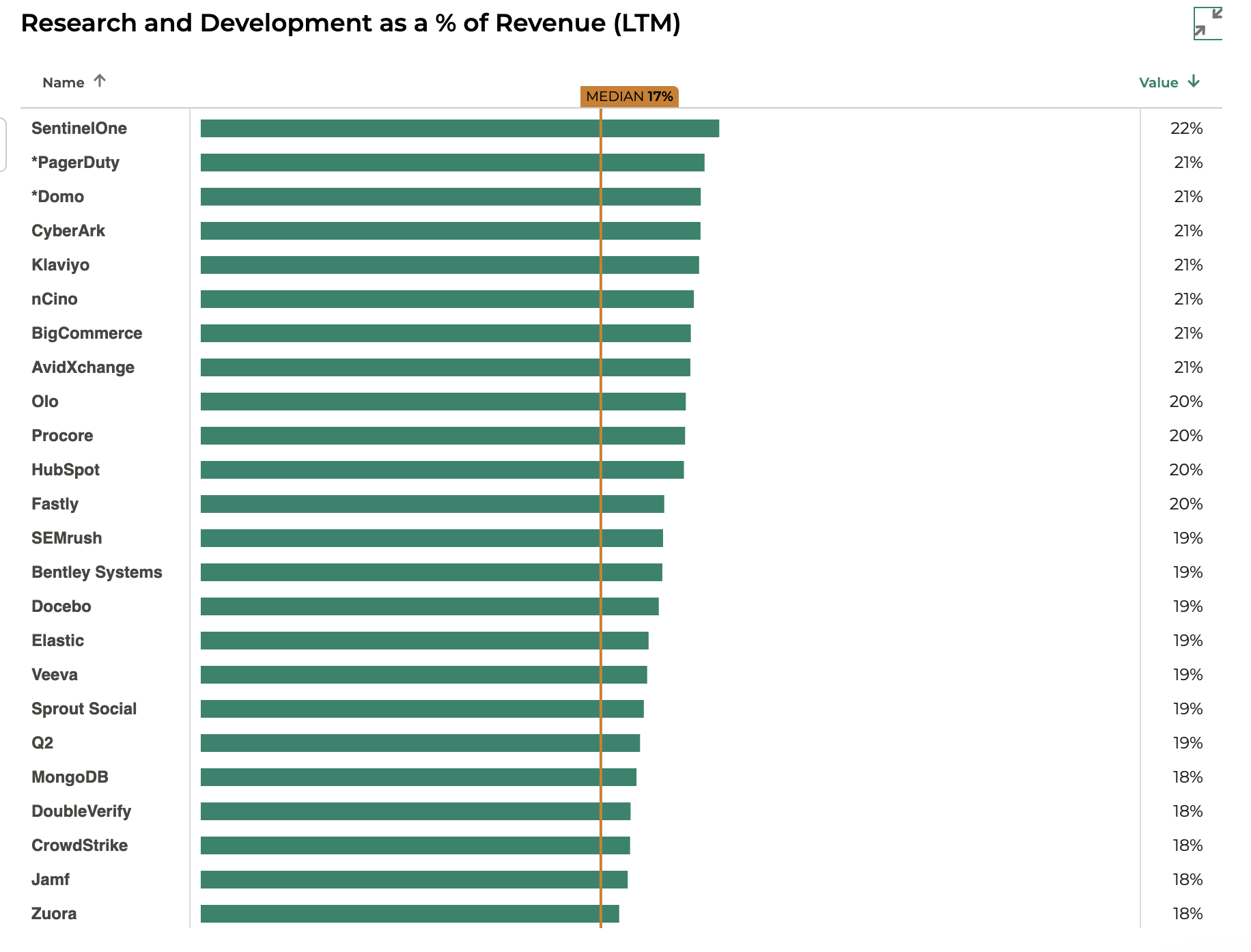

R&D Costs

The nature of a vertical software platform means needing to expand wallet share consistently and that usually leads to higher R&D costs. That’s true of ServiceTitan, too.

The median spend for R&D as a percent of revenue for mature companies typically lands between 15-20% unless the company is involved in deep tech or uses a product-led growth motion.

ServiceTitan comes in at a whopping 27% while still being high on S&M and G&A expenses - indicating that the R&D investments aren’t yet making the company more efficient.

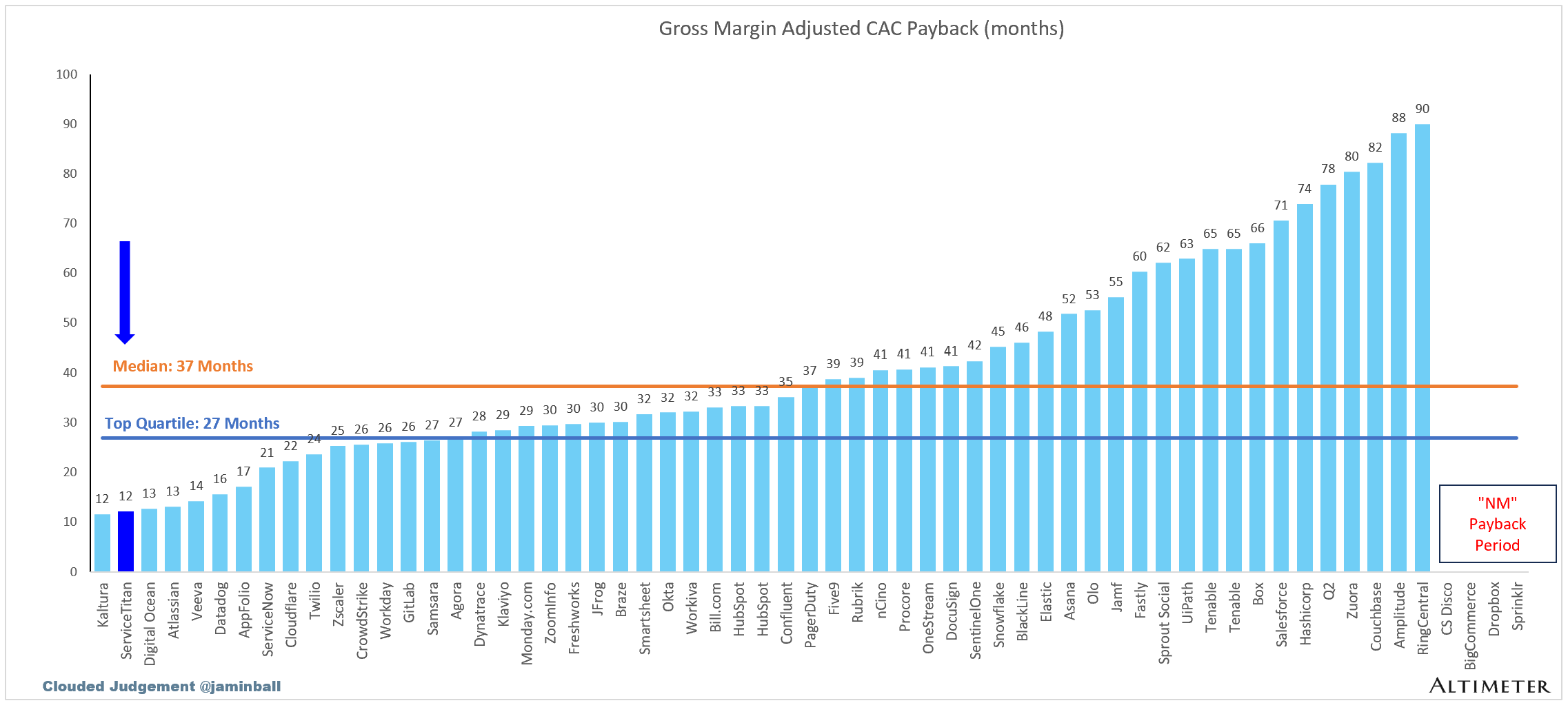

CAC and Payback Period

One of the best things about owning a space like ServiceTitan does with the trades is building brand recognition. That’s best measured by CAC payback and ServiceTitan is best in class here.

Why do I like this metric as a measure of brand? Low CAC often indicates some leverage in organic marketing - ex. customers just visit your website and don’t need to “discover you. A quick payback means either you are charging a premium that customers are willing to pay OR marketing costs are lower due to this organic marketing.

Profitability

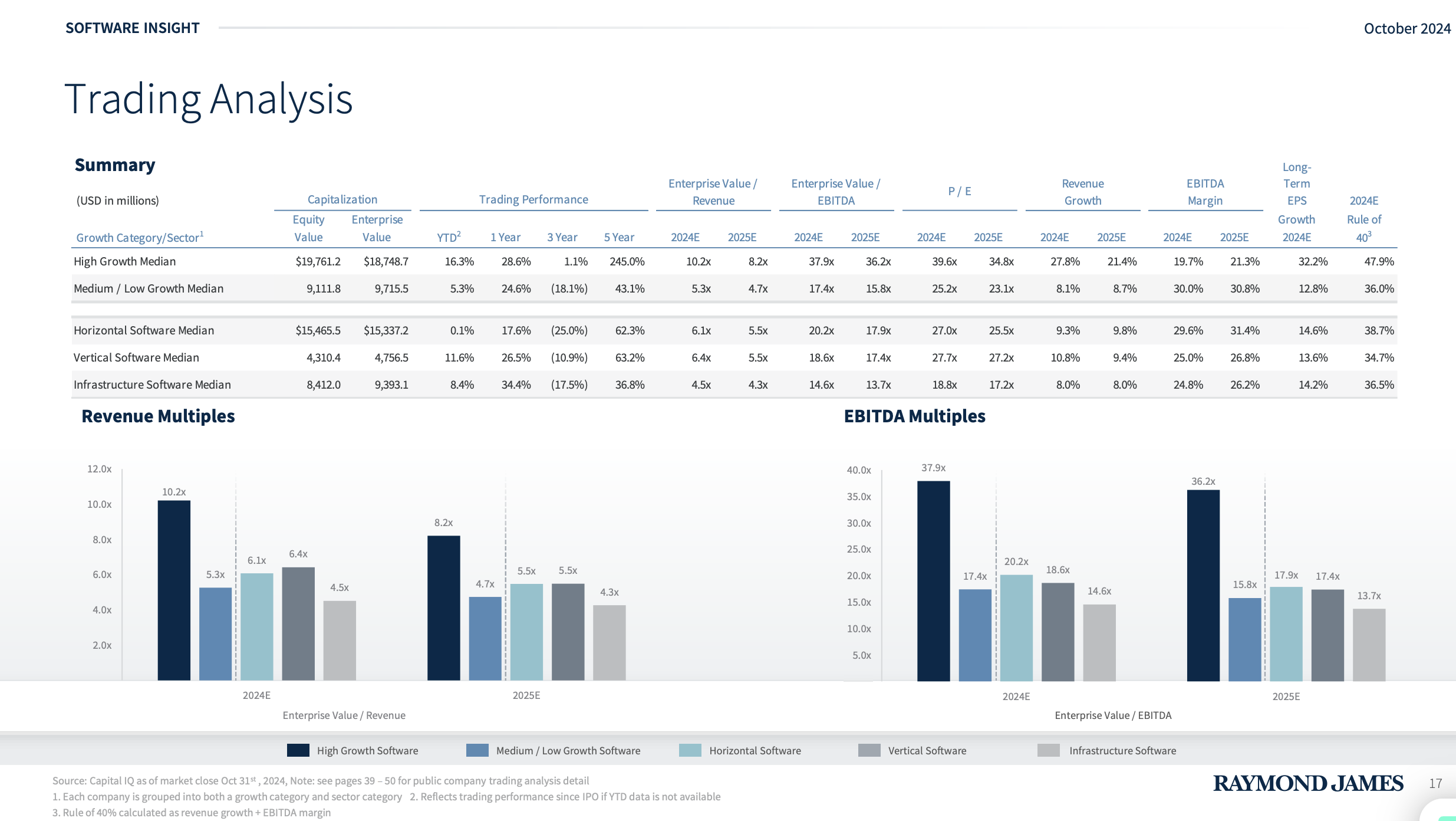

This is the elephant in the room on this IPO. The best private market companies currently trade at 21% NTM revenue growth, 21% NTM EBITDA, and a 48% Rule of 40.

ServiceTitan falls short here on EBITDA and Rule of 40. Their LTM numbers are 24% growth, -2% FCF (as a proxy for EBITDA), and a Rule of 40 of 24%.

Given that both public and private markets value a combination of growth and profitability, I genuinely do not know how this will be received by the market. I could see pent-up demand and excitement around HVAC creating a premium and I could also see punishment due to the profitability profile without mind-blowing growth. We’ll see.

Overall, I’m excited to see one of the best vertical software companies of the last decade debut on the public markets. And while it may not seem like it at first glance, this is one worth watching for anyone interested in software and the energy transition.

Signal Check

Powering the Future of AI: The Data Center Energy Crunch: Energize Capital’s look at data center growth and what it means for the power industry. AI is like a stimulus package for the energy transition in the wake of what could be a series of policy changes that create headwinds for the space. This deep dive takes a look at the trends and companies shaping this growth phase of our grid.

How to Think (and Work) Like a Billion Dollar Investor (Podcast): Hedge fund manager Adam Kerr discusses learning and investing techniques including: what CEOs he avoids, the simple ideas you should take seriously, the correlation between people's writing and their performance.

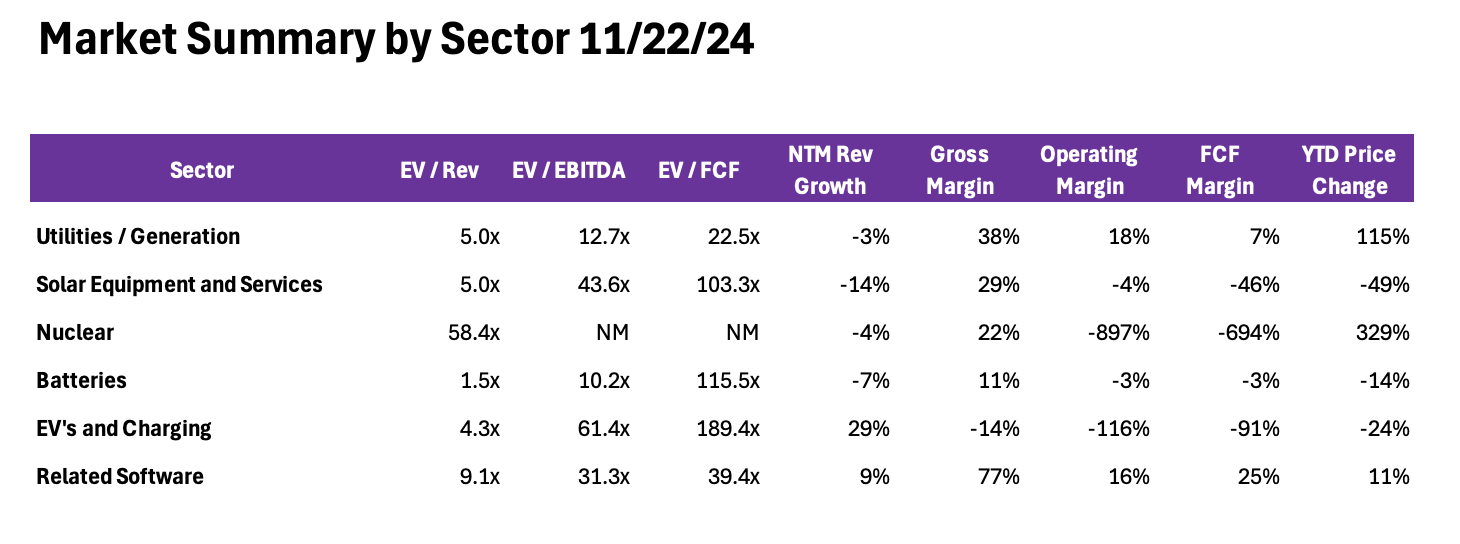

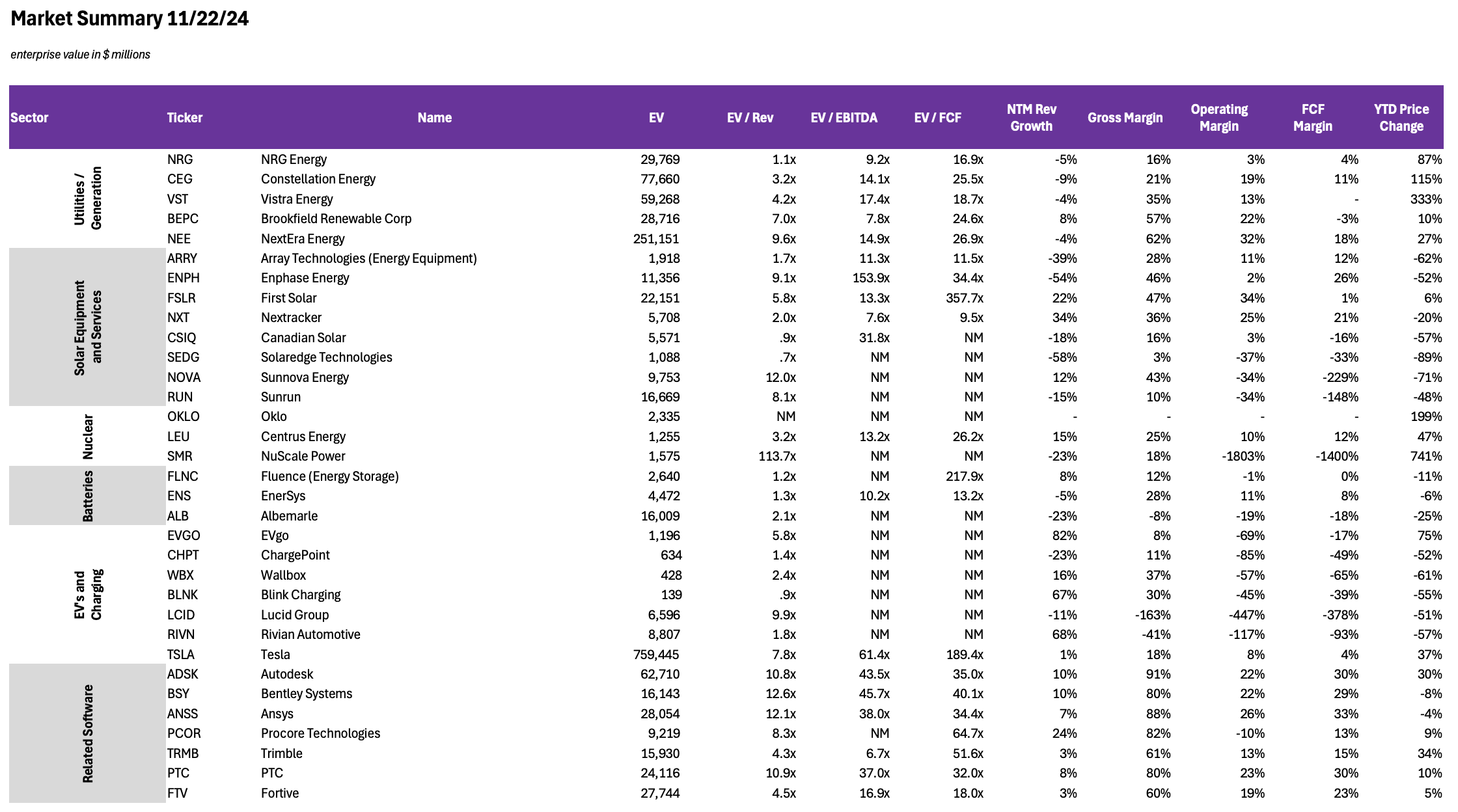

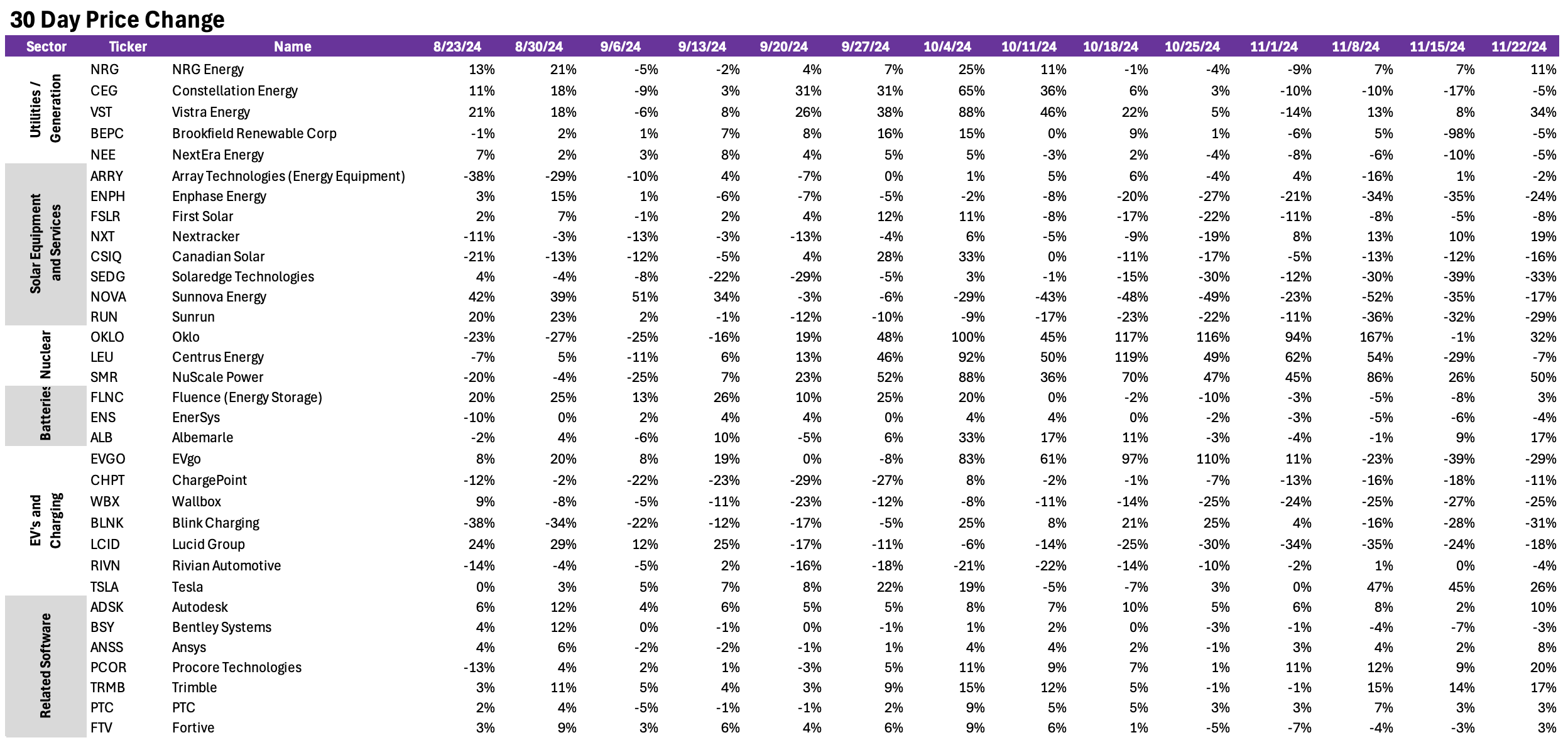

Market Pulse

Sources used in this post include Pitchbook and company filings.

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Energize Capital. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.