The Battle Between Statistics and Psychology

Deterministic and probabilistic thinking collide to shape how we think about investing.

Statistics has always been one of my favorite subjects. I love probabilities and bell curves because they help us understand how the world should eventually work.

Psychology falls into a similar boat. We have theories and studies predicting how humans should normally react on average.

Stats and psychology collide in the investment world everyday, including in the battle between deterministic and probabilistic thinking. Our mind naturally wants to go to deterministic - this will or won’t happen, zero or one type thinking informed by prior events - because we hate uncertainty. But, the world, especially the investing world, works in probabilities.

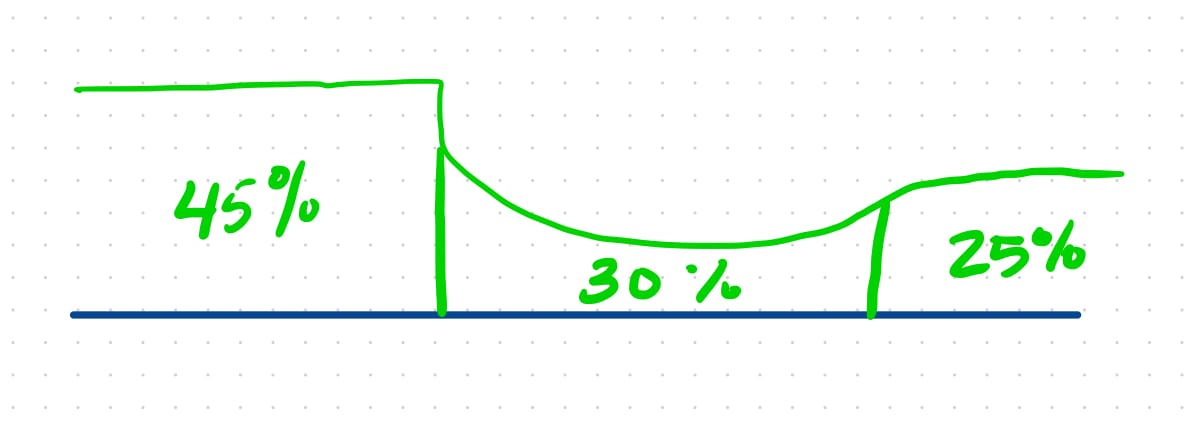

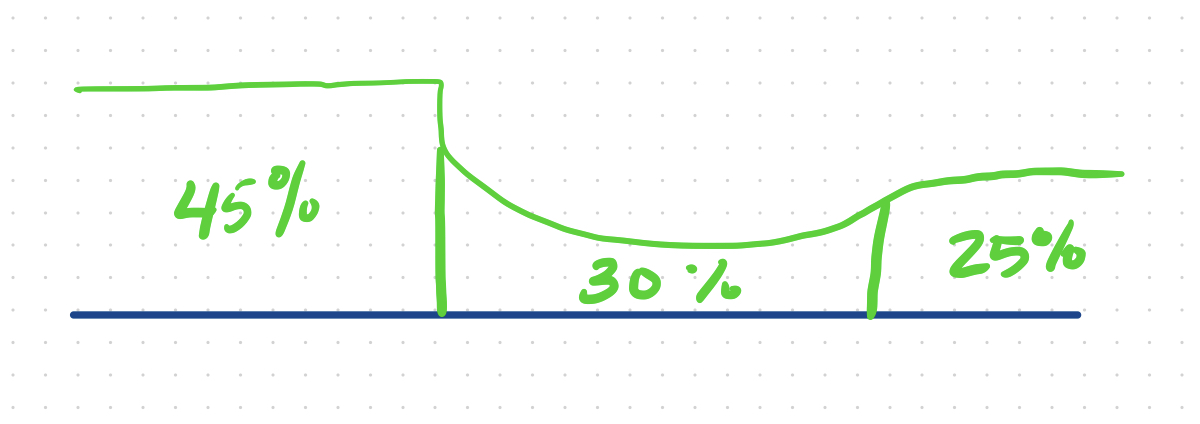

One great example is how we predict the likelihood a particular investment will perform over time. The numbers below are illustrative but stick with me.

When we say this is a high-upside business, we usually mean it’s more likely to end up in the tails of the outcomes—the bell curve in the above (terrible) drawing.

Venture capital works best when enough of the outcomes in a portfolio fall on the right side of the top bell curve. The trade-off in this bet is that you must take on the 45% on the left side of the bell curve to get the right 25%. The goal is to ensure that 25% is as large as possible.

The graph also doesn’t consider the size of the investment, only the outcome. This is why most investment firms write similar size checks for initial investment. If you get an outcome on the right side of the tail, it must be sufficient to create outsized returns. A rare winner with a small outcome is actually a disaster.

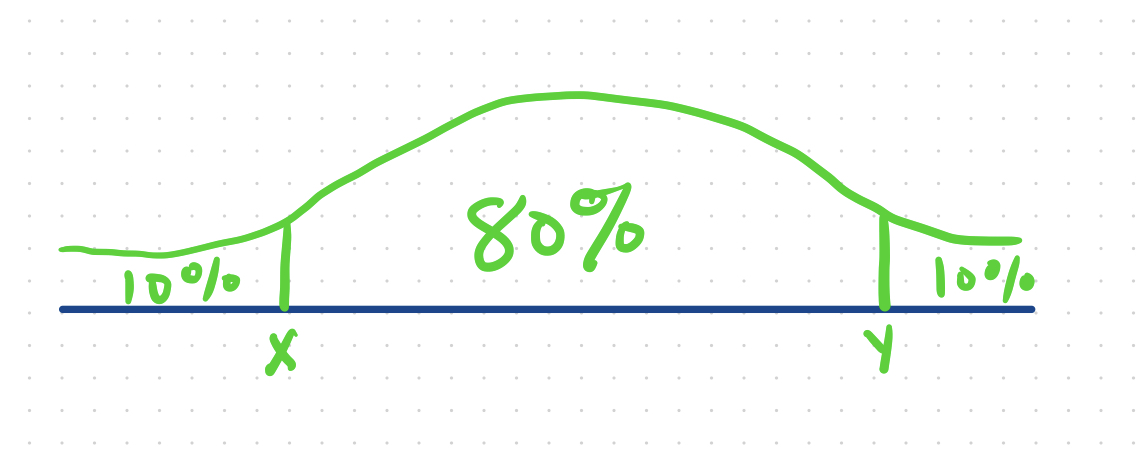

When we say a company’s upside is capped, what we really mean is that it’s more likely to fall into the middle, like this bell curve. The later the company, the more confidence we should have that returns will fall under that curve.

This is private equity style investing with the goal of having a solid idea of what it would take to land underneath the curve (between X and Y) and the potential of getting into the right tail. Anything in the left end of the tail is a disaster. The first rule of PE is “don’t lose money.”

The tricky part of all this is that it’s not our natural way of thinking. I enjoy stats and psychology, have thought on this concept for a few days, and had 30 minutes this morning to think it through. It still took me awhile to write it out (hopefully) clearly.

Now imagine you’re in a high stress situation. Deadlines, investment committees, etc… your brain (and all of ours) will likely go immediately to a derminsitic thought because we hate uncertainty. But that style of thinking often ignores the probabilities, and we live in a world governed by them.