The Renaissance of American Manufacturing

The energy transition comes to blue-collar labor in a big way

$20,000,000,000 and 13,000.

Since the passage of the Inflation Reduction Act last month, companies have announced $20,000,000,000 of investment in energy transition-related manufacturing facilities.

These investments will create over 13,000 direct jobs and many more indirect ones as suppliers battle to be closer to OEMs. Most of these jobs are being created in rural America where they are desperately needed.

$20,000,000,000 and 13,000.

If these two numbers don’t get you excited for the future of American manufacturing and the positive impact the energy transition can have on real lives, nothing will.

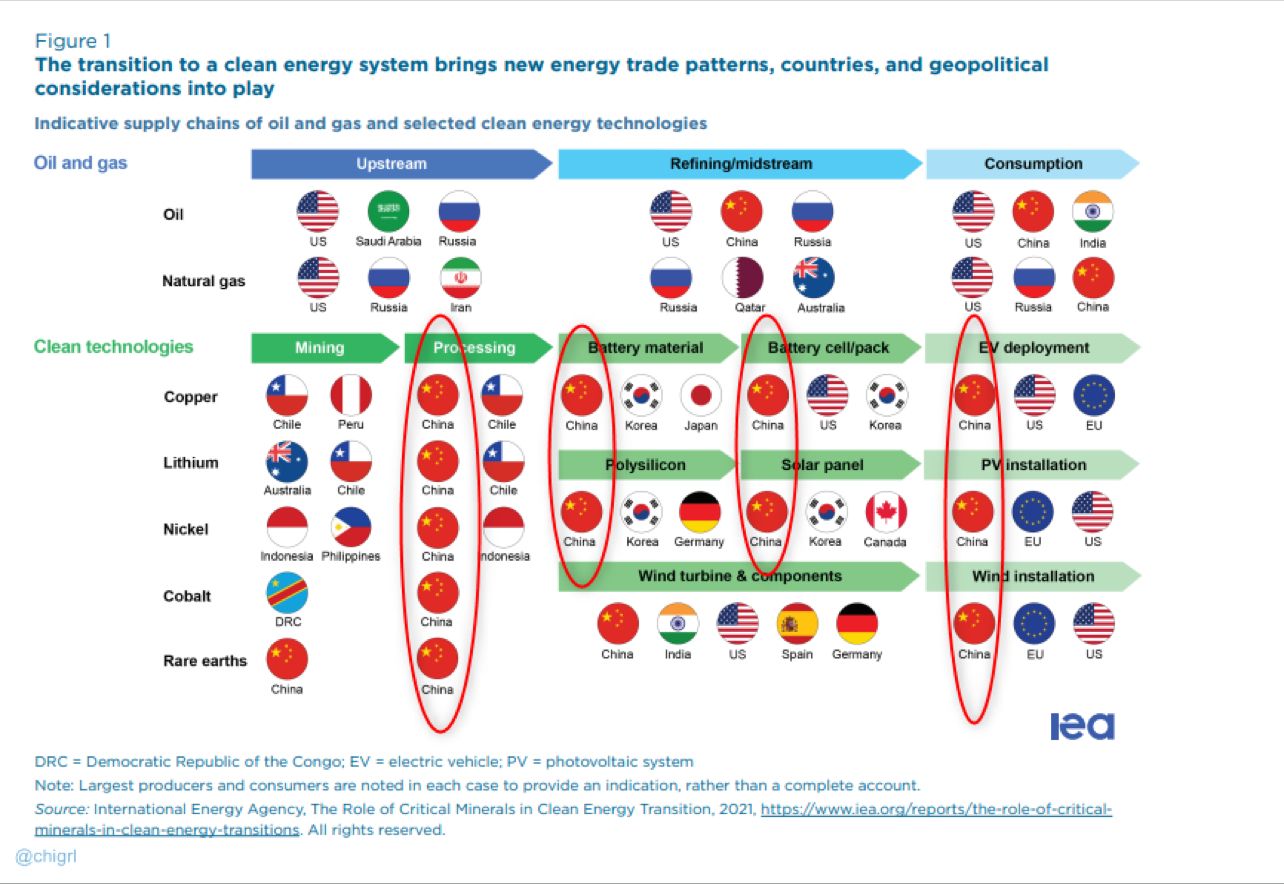

Truth be told, the investment is about a decade late and a necessity if the US plans on becoming more of a presence on the chart below.

Currently, China dominates every segment of the energy transition manufacturing supply chain and we need that to change in a big way.

What’s next?

There are three existential questions that are still unanswered but could define how the influx of investment in American manufacturing plays out.

- How do these new jobs get sourced? We currently have a severe labor crunch in this country. 77% of manufacturers already report having issues attracting and retaining skilled workers.

- What are the ramifications of factories becoming more automated and their output becoming a function of energy prices? Traditionally, the primary cost has been labor. Solar, battery storage, and electrification all take center stage as energy prices driven by natural gas continue to rise.

- How quickly can we meet the demand for the technologies once they are produced? Interconnection queues remain long, transmission permitting is painfully slow thanks to regulation and NIMBY-ism, and EV charging infrastructure deployment remains slow.

We need an answer to all three to get the increased capacity of assets in the ground and contributing to electrification. Energize portfolio companies like Aurora Solar and Sitetracker are leading the way.

What role will software play?

The IRA introduces several new mandates for sourcing materials that will require a level of granularity only software can provide. (Energize portfolio company Sourcemap is on the case!)

What role can computer vision + low/no code play in combing the powers of human labor with robotics? Companies like Osaro, Rapid Robotics, and Plus One Robotics are great examples of what’s possible.

Will this finally be the time for analytics and optimization to shine? Traditionally, both struggled to find scale, but things might be finally beginning to change. Next-gen optimization companies like Phaidra have new tailwinds to leverage.

The new renaissance of American manufacturing received a massive boost this year with the IRA and Chips Act, but it’s only the beginning.

If you’re building a software company that helps manufacturers become more efficient, cleaner, or transparent I’d love to hear from you!

Thanks for reading Sustainable Returns! Subscribe for free to receive 1-2 posts weekly!